U.S. pistachio production is projected to continue setting new records in years to come. Under normal economic and growing conditions, U.S. pistachio shipments are expected to keep pace with expanding U.S. supplies, and the price outlook remains positive. Industry-wide challenges, such as drought and regulations, exist going forward, but so do opportunities, such as export demand, plant-based protein diets and more.

Global Market Prefers Quality

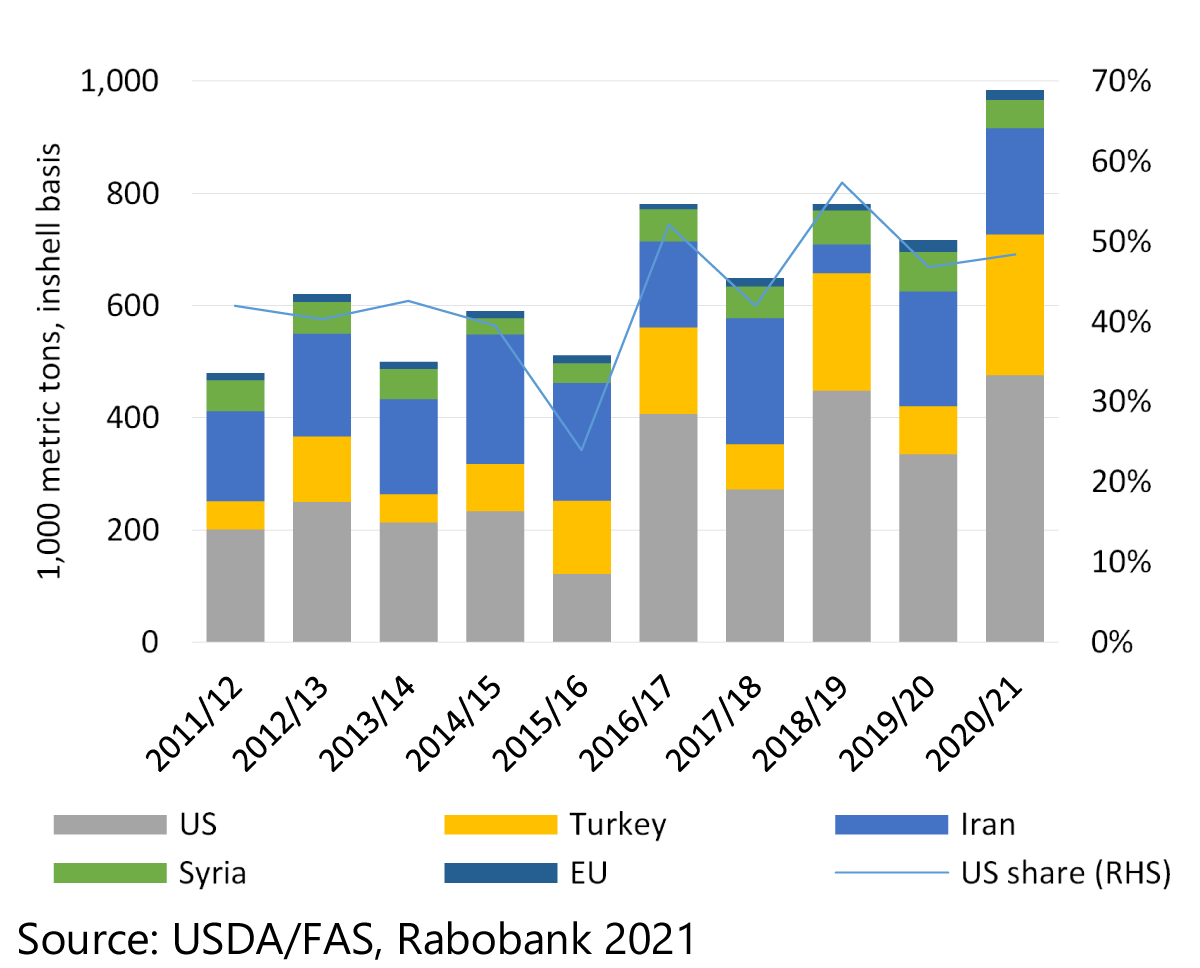

Pistachio production reached a new global record of over 980,000 metric tons, on an in-shell basis, during the 2020-21 marketing year, an astounding 26% increase compared to the previous record in 2016-17. The U.S. has established itself as the primary pistachio-producing country with a share of total pistachio production hovering around 50% over the previous five marketing seasons (Figure 1).

In 2021-22, however, global pistachio production will be down compared to a year ago as the U.S. crop is expected to show an ‘off year’ production level. Moreover, production in Turkey has shown a heavy alternate production pattern in recent years with a potential off year in 2021-22. Additionally, production in Iran was reportedly impacted by adverse weather events. The magnitude of the crop reduction still remains to be seen, but preliminary estimates show up to a 50% decline in Iranian production due to freeze damages.

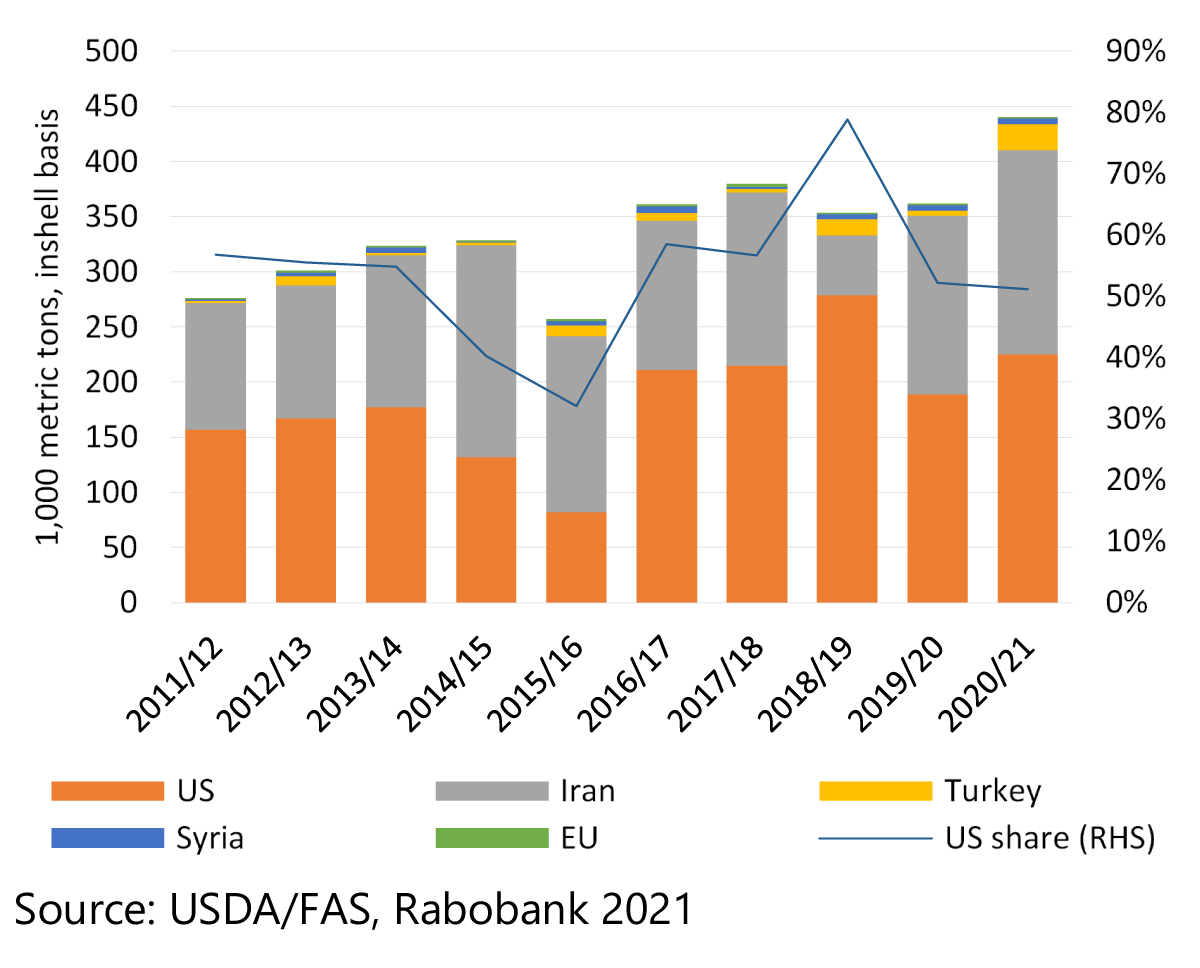

Typically, about half of global pistachio production is marketed internationally. Total pistachio exports will set a new record, according to USDA estimates, at about 440,000 metric tons during the 2020-21 marketing year. The U.S. pistachio industry started exporting pistachios about 40 years ago, a space previously dominated by Iran and Turkey. The U.S. has led pistachio exports since 2016-17, with more than 50% of global exports each year. Exports from Iran are the main U.S. competition in international markets (Figure 2, see left).

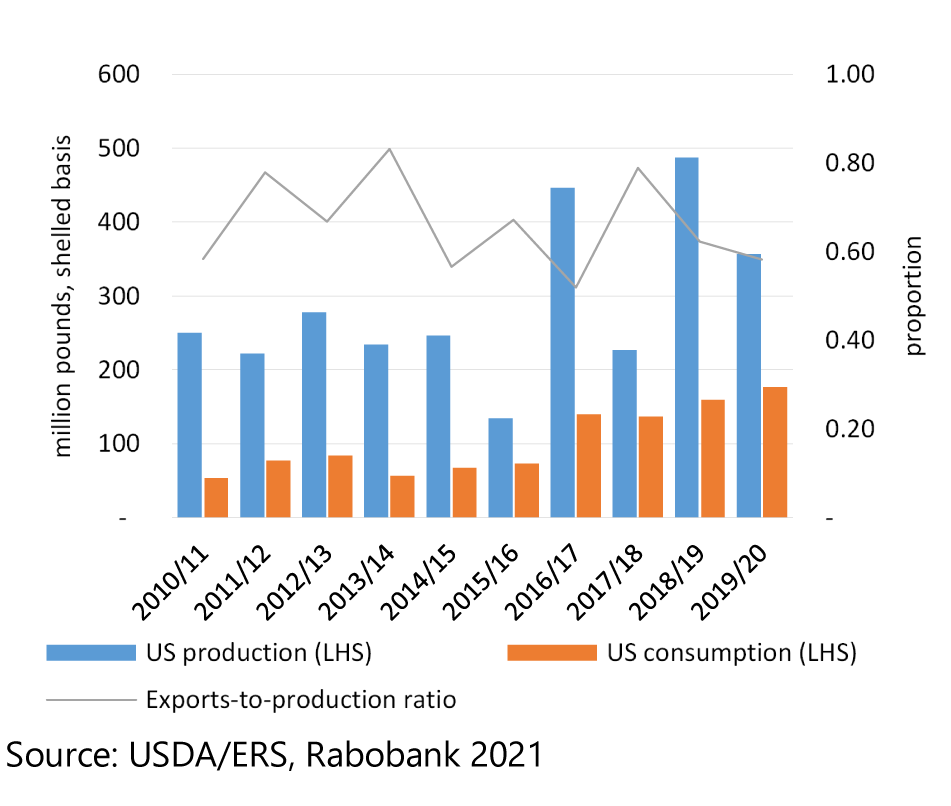

The 2020 U.S. pistachio crop had outstanding quality. Industry figures show that the percentage of open in-shell pistachios was about 83%, the highest proportion since 2012. U.S. pistachios are expected to continue being preferred in international markets because of the quality standards and food safety aspects. This is a key element, as exports are a critical demand segment for U.S. pistachios. During the last decade, the U.S. export-to-production ratio in this industry averaged about 67% (Figure 3).

U.S. Industry Growth to Continue

In 2020 U.S. pistachio production surpassed the 1 billion-pound mark for the first time, as California harvested an ‘on year’ crop. According to industry sources, pistachio prices have remained steady, despite record supplies. Year-to-date domestic shipments were up 7% year-on-year through the first eight months of the 2020-21 marketing year, while export shipments were up about 15% year-on-year during the same period.

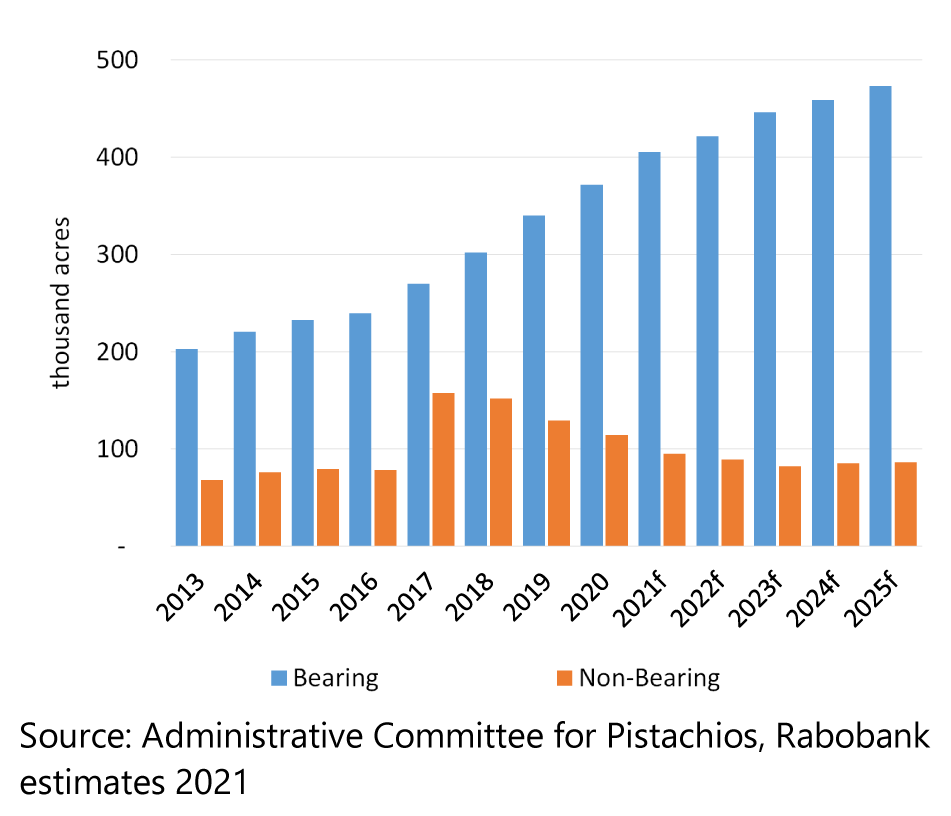

A growing demand, both domestic and abroad, will become increasingly relevant as planted acreage continues to expand. According to updated industry statistics, from 2012 to 2018, yearly new pistachio plantings in the U.S. averaged over 30,000 acres. Non-bearing acreage reached an all-time high in 2017 and has gradually declined since. From 2022 to 2025, non-bearing acreage may average around 85,000 acres. RaboResearch expects bearing acreage to continue to expand from about 370,000 acres in 2020 to slightly over 470,000 acres in 2025 (Figure 4).

Record-Breaking Crops Ahead

U.S. pistachio production has had a well-established alternate bearing pattern over the last several seasons. Although some believe that the occurrence of consecutive ‘on years’ is likely in coming campaigns, for our forecasts, RaboResearch assumes that the alternate bearing pattern will continue.

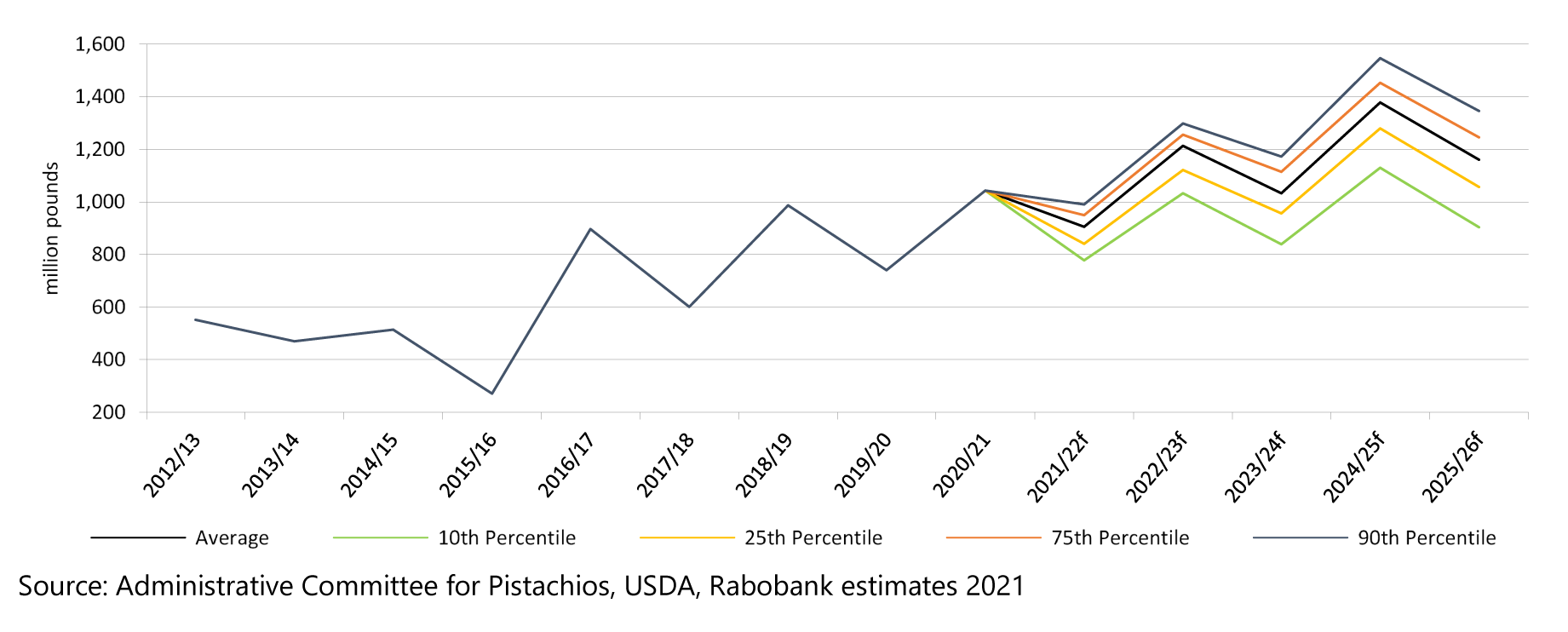

For the 2021-22 season, the updated average production estimate from Rabobank’s proprietary analytical tool is 904 million pounds, with a 50% chance of it being between 841 million pounds and 949 million pounds. The range of likely yields skews lower more than higher because the downside yield risks, due to the potential for unfavorable weather and growing conditions, tend to outweigh the potential for optimal conditions. The coming 2021-22 crop is expected to be the third largest on record, the largest yet for an off year, and only lower than the on-year crops in 2018-19 and 2020-21.

Given the planted acreage, age of trees and typical yield probability distributions, we expect overall record crops in 2022-23 and 2024-25, while we could see record highs for an off-year crop in 2023-24 and 2025-26 (Figure 5).

Improved Outlook for U.S. Pistachio Exports

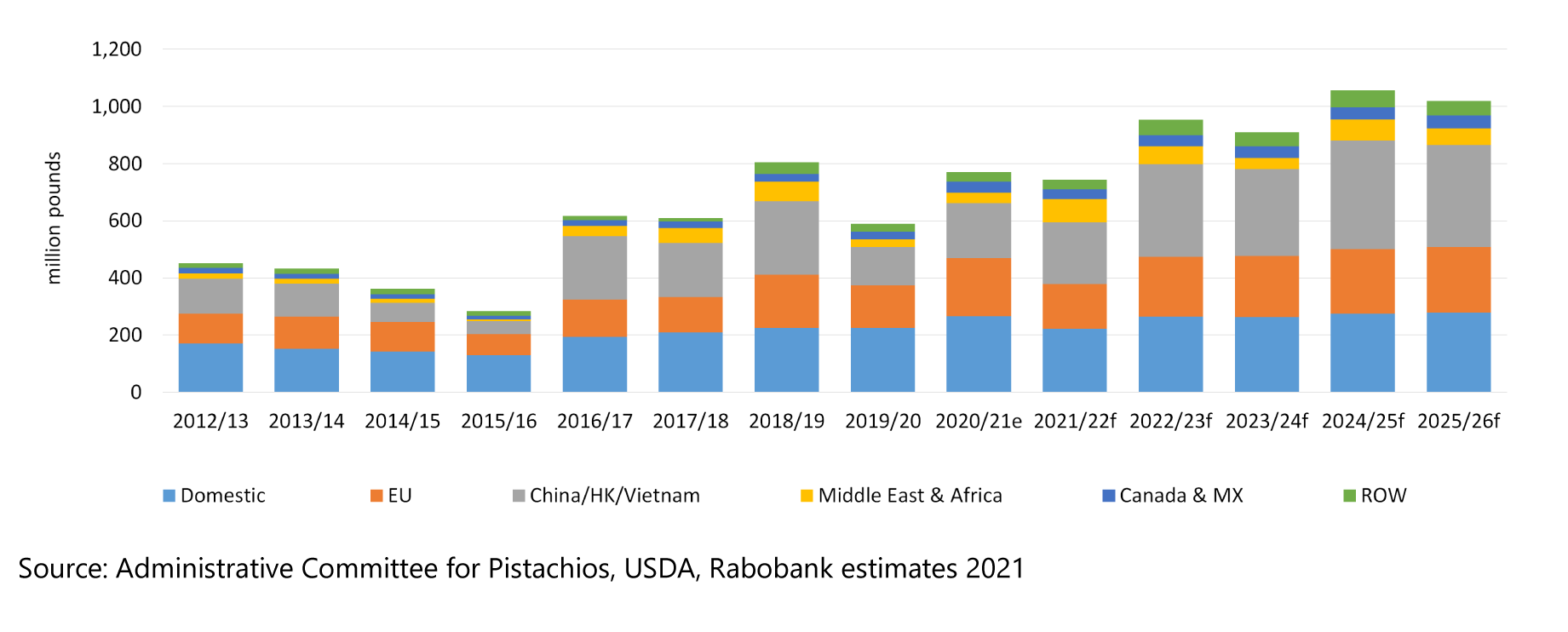

Total shipments in 2020-21 will probably not reach the record levels observed in 2018-19. But less competition from Iranian pistachios could help boost shipments to healthy levels in 2021-22 (Figure 6). As long as the U.S. has freer market access to key Asian markets from 2022-23 onwards and sustained export growth to Europe, total U.S. pistachio exports are expected to keep pace with expanded U.S. supplies. In general, smoother year-on-year shipments, when compared to production, are to be expected in the next few marketing seasons.

Domestic shipments will likely reach close to 300 million pounds by 2025-26, up from about 150 million pounds at the beginning of the previous decade. Domestic shipments could grow faster if per capita consumption continues expanding at current rates, but that impressive annual growth rate will be difficult to maintain.

Grower Prices to Remain Firm

Industry and government sources have reported that returns to the grower, on average, have been higher than $2.60/in-shell pound and $2.80 for 2018-19 and 2019-20, respectively. The average price in 2020-21 is expected to be around $2.75/lb. RaboResearch expects average returns to the grower (base price plus bonuses) to be around $2.69/lb for the 2021-22 to 2025-26 period.

Overall, the average price outlook for U.S. pistachios is favorable (Figure 7), while relevant industry-wide challenges and opportunities lie ahead. The estimate for 2022-23 shows that a price between $2.24/lb and $2.86/lb has a 50% chance of occurring. For the 2023-24 marketing year, the estimated probability of observing prices lower than $2.00/lb is just 10%. On the other hand, there’s a 10% chance that total returns to the grower reach $3.40/lb. That price was a reality in the recent decade during the previous drought in California.

Challenges and Opportunities

The primary challenges facing the U.S. pistachio industry include severe drought conditions in California, meeting water and environmental regulations, soil salinity and increasing input costs. A silver lining here is that pistachios tend to adapt better to different soil types and have relatively higher tolerance to salinity than competing crops. Also, gross economic margins per acre have typically been higher for pistachios than those for other tree nuts. This difference has been exacerbated during the current marketing year as the prices for other major tree nuts came under pressure while pistachio prices held up better even in a backdrop of abundant crops.

Opportunities for the U.S. industry in the short run include potentially lower availability of pistachio production in the Middle East, particularly from Iran. Most of the demand growth is expected to come from export markets. Less competition in the global market opens the possibility for higher U.S. shipments. Moreover, after some COVID-19 related market and logistic disruptions, the supply chain should continue to improve. The global economic recovery should also boost demand, including a renovated demand from the foodservice channel.

As for domestic trends, per capita consumption has expanded at a compound annual growth rate of over 10% during the recent decade, surpassing the growth rate of most fruit and nuts. The pistachio industry in the U.S. is relatively young. Some industry players classify it as adolescent with plenty of room for growth.

Pistachios are recognized as healthful and not only a high-protein product but a complete protein. Further innovation and strategic partnerships are needed to continue to capitalize on plant-based protein diets as well as the demand from health-conscious consumers for confectionary bars and gourmet products that can contain pistachio kernels. Research and promotion on healthfulness will continue to be important demand drivers.