The California almond industry has seen remarkable growth over the past couple decades. Can additional growth and high prices be sustained? We discuss expected changes in demand and supply moving forward, with implications for the success of California’s almond industry.

California produces nearly all of the almonds grown in the U.S. and is also the world’s dominant almond producer. The remarkable growth of the California almond industry represents perhaps the greatest success story in California agriculture in recent decades. California’s bearing almond acreage expanded from 418,000 in 1995 to 1,250,000 in 2020. Production rose over this same period from 370 million pounds to a projected 2.8 billion pounds for the 2020-21 crop. With a farm production value of about $6.1 billion for the 2019-20 crop, almonds have vaulted to third place among California agricultural commodities, trailing only the dairy and grape industries. Both domestic and international shipments of California almonds have grown steadily from 2014-15 onward, with about two-thirds of the crop designated for export sales. The U.S. share of world export sales, which is dominated by California, also increased over 2014-18, and now stands at about two-thirds.

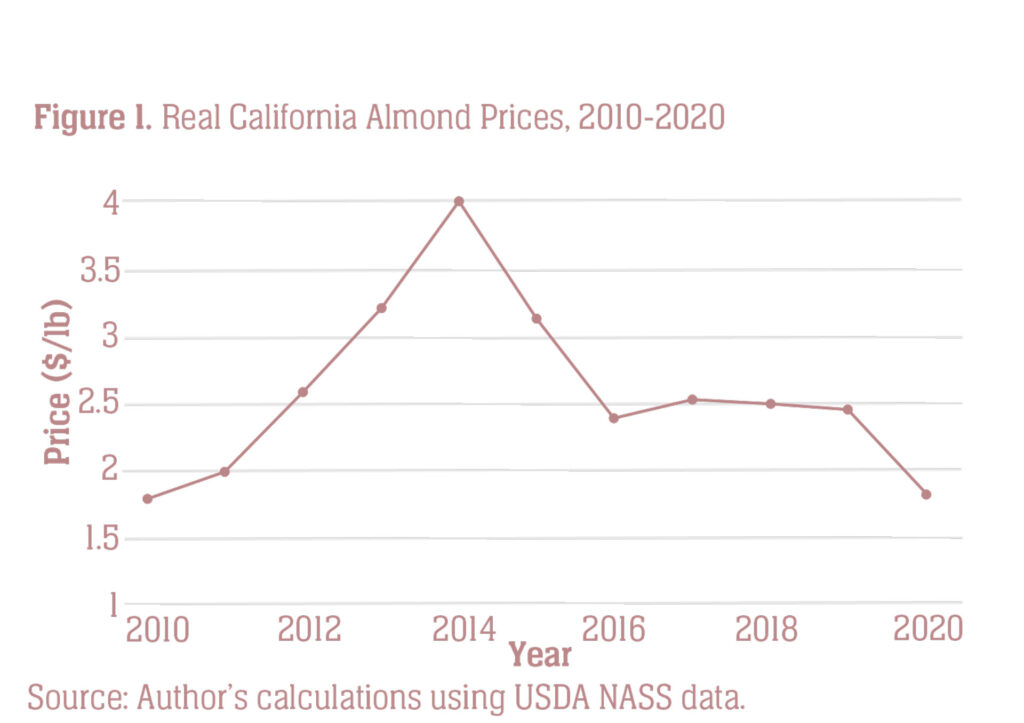

Such dramatic growth in the supply of an agricultural product would normally cause precipitous price decreases, and, indeed, many analysts have erroneously forecasted this fate for the almond industry. It has not happened, however. The grower price per pound fluctuated considerably from 2010-2015, ranging from a low of $1.79 per pound in 2010 to a high of $4.00 in 2014. It then settled into a very stable range in the ensuing years, with the price fluctuating in a narrow band of $2.39 to $2.53 from 2016 to 2018 (See Fig. 1).

Prices dropped in 2020 to $1.83 per pound, an outcome we regard as an aberration due to multiple factors: trade disruptions and reductions in consumers’ incomes caused by the COVID-19 pandemic, trade disputes between the U.S. and key importing countries, as well as a record supply of almonds in 2020 due to the highest per-acre yields since 2011. Since the release of the USDA 2021 California Almond Objective Measurement Report, which projects a smaller crop than anticipated for 2021, almond prices have rebounded to pre-2020 levels. According to Merlo Farming Group, Nonpareil in-shell prices increased roughly 19% from $2.33 to $2.75 per pound between July 13, 2021 and July 18, 2021.

Growth in Demand

Despite the dramatic expansion in supply, prices have been relatively stable because demand has grown as fast as or faster than supply. Both domestic and export markets have experienced significant demand growth. Domestic shipments increased from 639.4 million pounds in 2014-15 to 774.3 million in 2019-20, an increase of 21.1%. Export sales expanded over this same period from 1,173 million pounds to 1,598 million, an increase of 36.2%.

Expanded sales in both China and India are key factors in international demand growth. Collectively, China and India account for about 35% of the world’s population, and each country has experienced very rapid economic growth. From 2010 to 2019, China’s annual GDP growth rate ranged from 6.1% to 9.5%. India’s GDP growth rate in 2019 was 4.2%, but from 2010 to 2018, its growth rate ranged from 6.1% to 10.3%. By comparison, GDP growth for the U.S. from 2010–2019 ranged from 1.6% to 2.9%.

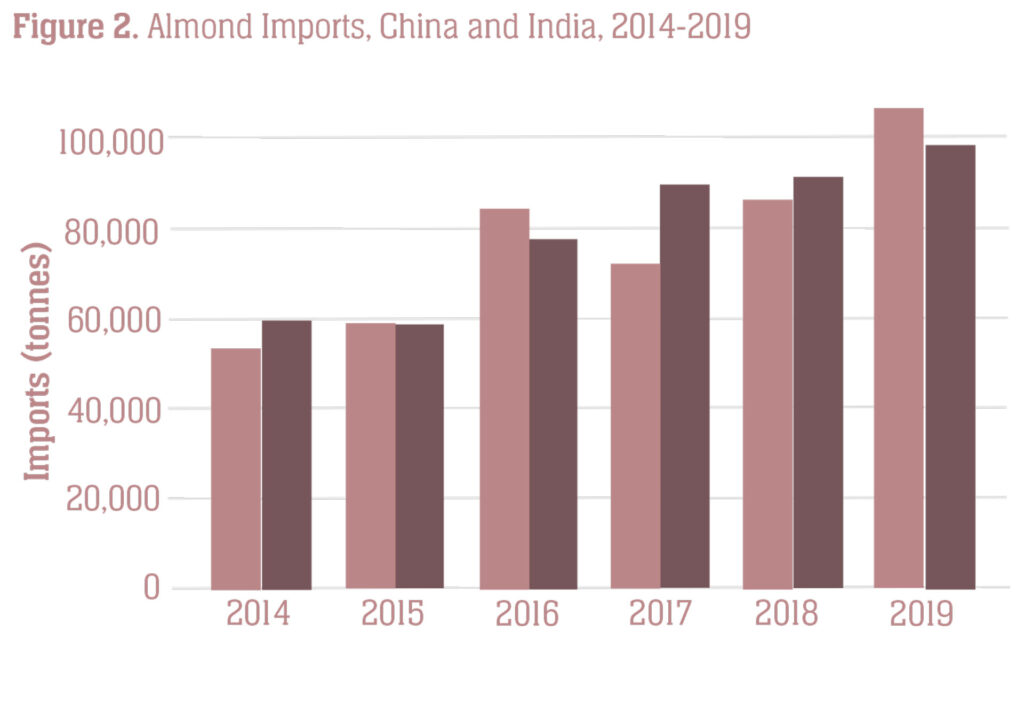

The rapid economic growth of these high-population countries has had a dramatic effect on world food markets. Consumers in both countries have sought to diversify their food consumption and include more proteins in their diets. Almonds have been a primary beneficiary of these consumption trends as illustrated in Figure 2. While world imports of almonds (shelled plus in-shell) expanded at a significant 42% over the six-year period from 2014 to 2019 based on UN Food and Agriculture Organization (FAO) data, almond imports to China and India (measured in shelled tonnes) expanded 106.7% and 69.6%, respectively.

However, despite the dramatic increase in almond consumption in these two countries, per capita consumption in each (0.14 pounds in China and 0.16 pounds in India) is only about 6% of per capita consumption in the U.S. (2.33 pounds). The Asia-Pacific market now accounts for 27% of California almond shipments. However, these consumption comparisons show that significant growth potential remains for almonds in these major markets as well as for other emerging economies as incomes grow and people seek to diversify their consumption beyond traditional staples.

Although the domestic (U.S.) and Western European markets, which have been the traditional leading markets for almond exports, are mature markets, there is also evidence of growth in these markets in recent years and potential for more growth in future years. As noted, domestic shipments of almonds expanded 21.1% over the last five years. The two leading Western European importers are Spain and Germany. Spanish almond imports expanded 32.5% in the past five years, while German demand growth has been much slower, 3.5% over the past five years. Spain has historically been a major almond producer and developed a substantial manufacturing industry for almond products. As Spain’s own production has waned, it has been necessary to import almonds to sustain these industries. Thus, growth in Spanish imports is both demand-based and also reflective of the decline in Spain’s own production.

In addition, the almond industry benefits from the recent popularity of plant-based proteins as an alternative to traditional meat and dairy products. The Plant-Based Foods Association claims $7 billion in sales in the past year and 27% year-over-year growth in 2020. One market research firm, Grand View Research, predicts a compounded annual growth rate (CAGR) for almond milk of 14.3% through 2025 (http://bit.ly/36QC7nt).

Changes in Supply

Given the rapid growth that we anticipate in almond demand moving forward, fueled by economic growth in high-population, emerging economies and by new product uses for almonds, the remaining piece of the puzzle is to understand how supply is likely to respond moving forward. There are three essential components to consider: 1) acres of almond production in California; 2) California almond yields; and 3) almond production and exports from competing countries.

The USDA projects California bearing almond acreage to be 1,330,000 in 2021, an all-time high. However, signs indicate that the rapid growth in the California industry is abating. New plantings of almonds have decreased in magnitude each year since 2015 when 42,824 acres were planted to almonds, with only 14,808 acres planted in 2020. A common assumption in the industry is that an almond orchard has a life of 25 to 30 years, meaning orchards planted in the early to mid-1990s are nearing the end of their productive lives. The rapid expansion of the industry began during this period, with almond plantings from 1994 to 1999 averaging 25,316 annually.

The rate of new plantings experienced in 2019 (22,142 acres) and 2020 (14,808 acres), if representative of future trends, would not compensate for the acres that will be removed at the end of their productive lives, meaning that growth in California’s almond acreage may soon be ending. Many factors could explain the decline in planting despite the industry’s continued profitability, including concerns about access to irrigation water, a heavy reliance on the U.S. beekeeping industry for pollination services, and limited availability of lands suitable for planting almonds. California’s Sustainable Groundwater Management Act of 2014 augurs likely cutbacks in groundwater availability for huge swathes of California’s agricultural lands. Almonds are an especially “thirsty” crop and are likely to be impacted by these cutbacks.

Almond yields in California expanded dramatically in the 1990s, fueling the supply growth along with expanded acreage. Although yields have been variable, they continued, on average, to expand through the early 2000s, reaching a maximum of 2,540 pounds per acre in 2011. Since then, however, yields have stabilized and even may have trended slightly downwards. Declining yields are likely in part a result of a higher proportion of young orchards due to rapid acreage expansion from 2012 to 2015. Other potential contributors include changes to the growing-season climate and the planting of new acreage on land less suitable for almonds. Data for 2019 and 2020 indicate yields of 2,170 and 2,490 pounds per acre, 370 and 50 pounds less, respectively, than at the 2011 peak.

Exports of almonds from countries other than the U.S. have been stable over the past five years, with no apparent trend, and, in total, represent only about half of what the U.S. exports. Traditional almond producers and exporters such as Spain, Iran, Morocco, Syria, Turkey and Italy have aging, low-yielding trees and show little potential for expanded production. Today, production in these countries mainly serves their domestic markets.

The one country where almond acreage and production is expanding is Australia. The Almond Board of Australia (ABA) reports 55,000 hectares (136,000 acres) planted to almonds, with 2020 production totaling 111 thousand tonnes, the largest harvest to date. The ABA forecasts that Australian almond production could reach 175 thousand tonnes (385.8 million pounds) by 2026, approximately 13% of the 2020 California production.

Australia’s almonds are mainly grown in the Murray-Darling Basin region, and over half of Australia’s almond exports are to China and Hong Kong (which is a significant re-exporter). The Murray-Darling Basin is Australia’s major agricultural region, but it faces many challenges due to a lack of water resources. Australia’s Almond Board indicates that almond orchard expansion has slowed, and almond growers in the basin have called for a moratorium on further almond plantings in the basin due to fears of water shortages. Australia represents one of the only threats to California’s hegemony in the market, but this threat is muted by water issues in the Murray-Darling Basin.

Concluding Remarks

Although market conditions for almonds deteriorated beginning in June 2019 due to the COVID-19 pandemic, trade disputes between the U.S. and key almond-importing countries, and the exceptionally large 2020 California harvest, we do not regard any of these developments as reflecting a long-term trend. Normal yields and normal market conditions should cause prices to return to pre-pandemic levels; in fact, this seems to have occurred with recent rebounds in market prices.

In summary, market conditions are likely to remain strong for almonds moving forward. We anticipate continued significant growth in export sales driven by China, India, Vietnam and other fast-growing emerging economies. The domestic market also has potential for solid growth based on the health benefits associated with eating almonds and the rapidly growing market for plant-based alternatives to meat and dairy.

We expect the growth in California’s production to slow moving forward. Plantings have slowed to the point where, at the present pace, they are unlikely to match removals as trees planted in the early to mid-1990s reach the end of their useful lives. The main threat for emergent competition in the export market is from Australia, but it appears that Australia’s ability to expand production is limited due to water scarcity issues.

The authors of this article can be reached at ebruno@berkeley.edu, bkgoodrich@ucdavis.edu, and rich@primal.ucdavis.edu, respectively.

Additional Information

U.S. Department of Agriculture, National Agricultural Statistics Service. 2021. 2020 California Almond Acreage Report. Available at: http://bit.ly/3wUXK0x .

Davies, Anne. 2019. “Tough Nut to Crack: The Almond Boom and Its Drain on the Murray-Darling.” The Guardian. Available at: http://bit.ly/3hWPdpm .

Suggested Citation

Bruno, Ellen M., Brittney Goodrich, and Richard J. Sexton. 2021. “The Outlook for California’s Almond Market.” ARE Update 24(6): 9–11. University of California Giannini Foundation of Agricultural Economics.