In this article, we summarize some considerations for the 2022 almond pollination season, including results from a 2021 survey of commercial beekeepers regarding their almond pollination agreements. The survey results provide insights on pollination fees, agreement details related to advance payment and limiting pesticide exposure as well as beekeeper preferences for bee-friendly cover crop mixes.

Almond Industry Update

Almond prices rebounded this summer due to a lower-than-anticipated almond crop for the 2021-22 marketing year following roughly a year of low almond prices. Relatively low competition from other exporting countries, coupled with steady growth in almond demand have kept almond prices strong despite monumental growth in production over the last two decades (Bruno, Goodrich and Sexton 2021).

The Almond Board of California and Land IQ estimate the removal of around 48,000 acres of almonds by September 2021, approximately 3.6% of the 1.3 million bearing acres in 2021. This is up slightly from 2020, with an estimated 39,000 acres removed. Aging orchards are the likely candidates for removal, and a few industry sources speculate the removal of additional orchards after harvest this year due to water scarcity concerns from consecutive years of drought and expected limitations due to the Sustainable Ground Water Management Act. Land IQ estimates 13% of almond orchards are more than 21 years old, compared to 20% of young orchards that will begin bearing in one to three years. Between June 2019 and May 2020, nurseries reported 66,000 acres of sales, with over half being for new orchards and the remainder replacing aging orchards. These numbers suggest that almond acreage is still expanding, though likely at lower rates than previous years due to the recent low prices and uncertain water availability.

Colony Demand

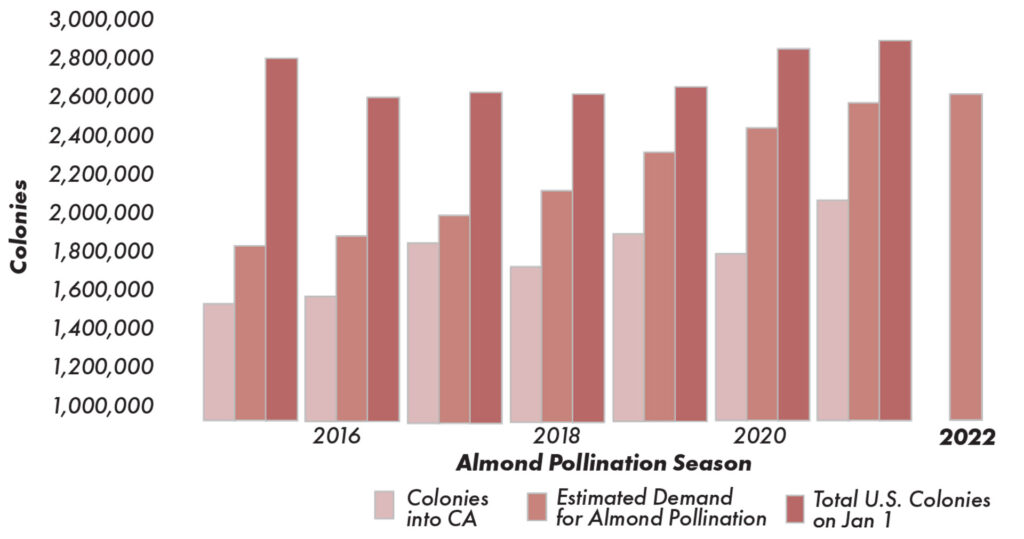

Figure 1 (see page 42) plots the estimated demand for colonies based on bearing almond acreage each year from 2015 to 2022 as well as the total colony shipments into California for almond pollination and the total number of colonies in the U.S. on January 1. Estimated demand is calculated using two colonies per acre for traditional varieties and one colony per acre for self-fertile varieties (Shasta and Independence). A consistent gap between estimated demand and colony shipments is filled by colonies that remain in California year-round. For the 2021 almond bloom, roughly 1.3 million almond acres (3.3% in self-fertile varieties) required an estimated 2.6 million honey bee colonies for pollination (Figure 1, see page 42). According to apiary shipment data provided by CDFA, other states shipped 2.1 million honey bee colonies into California for the 2021 bloom, up 16% from 2020.

As seen in Figure 1, the estimated demand for colonies in 2022 is 2.63 million colonies, slightly above that of 2021. It seems the recent increase in self-fertile variety plantings have started leveling off the estimated demand for colonies. However, the required colonies for almond pollination in 2022 still represent 90% of the 2.92 million colonies in the U.S. on January 1, 2021, so at least in the short run, it’s unlikely this leveling off of demand will put downward pressure on pollination fees. Additionally, an article published in Nature found the Independence variety showed an increase in yield by 20% from allowing bee visitation (Sáez et al. 2020). The researchers used the standard stocking rate of two colonies per acre. This study eliminates any claims that these self-fertile varieties do not require honey bee colonies for commercial production. Growers of self-fertile varieties who do not currently place honey bees in their orchards are likely “borrowing” pollination services from neighboring orchards. In the future, growers with traditional orchard varieties surrounded by many self-fertile orchards with few (or no) colonies per acre may have to compensate by placing more colonies per acre.

Weather Impacts on Colony Supply

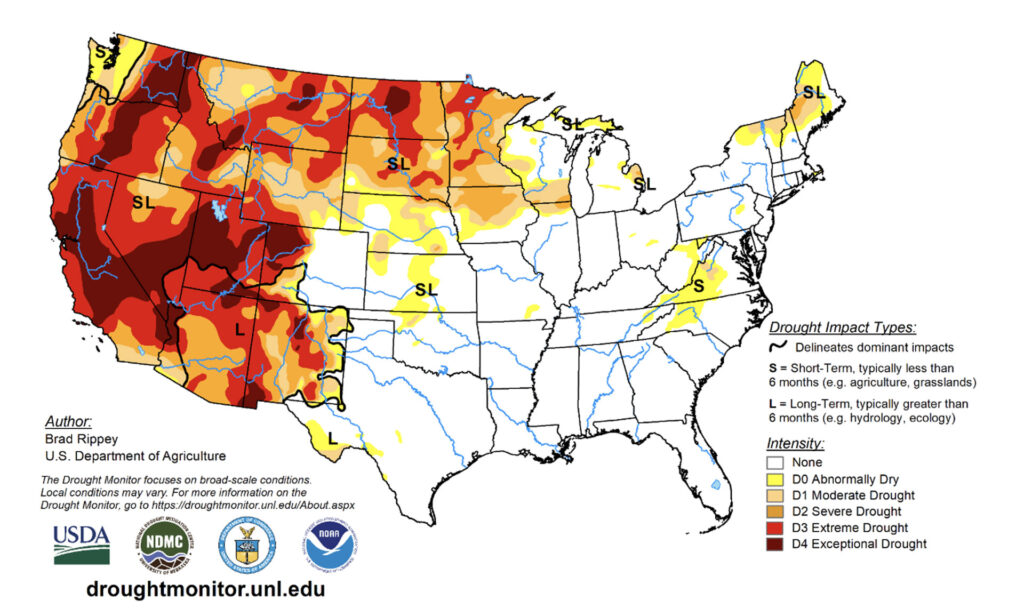

Much of the western U.S. and major honey producing states in the northern plains have been under severe drought conditions throughout the summer, which could have implications for colony strength and numbers for the upcoming almond pollination season. Figure 2 shows the U.S. drought monitor for the week of July 27, 2021, a time when major honey flow should have been taking place in states where most commercially managed honey bee colonies are located for honey production in the summer (North Dakota, South Dakota, Montana). As of the week of October 12, 2021, 35% of the U.S. was still in a severe drought or worse. Consequently, many commercial beekeepers have seen decreased honey production, increased costs of feeding and poor colony nutrition, all likely to negatively impact the supply and strength of colonies for almond pollination.

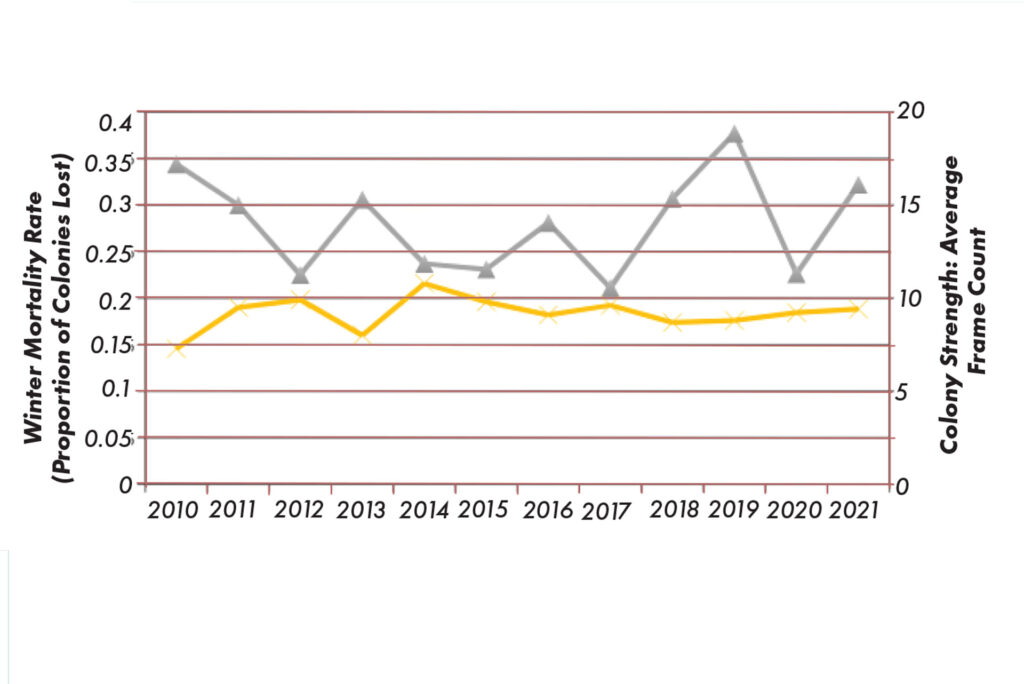

To get an idea of potential impacts of this drought, we looked back to 2012 when a similar drought took place. In October 2012, approximately 40% of the U.S. was in a severe drought or worse, slightly more area affected than our current situation. According to national honey yields from USDA, the 2012 honey crop was the lowest production in over 30 years. Figure 3 (see page 42) shows winter mortality rates and colony strength delivered at almond pollination for years 2010-21. Following the 2012 drought, winter mortality rates were 31%, according to Bee Informed Partnership (BIP), 38% higher than the previous winter. Average colony strength delivered for 2013 almond pollination dipped 20% lower than the previous year. 2022 almond pollination could see similar impacts on colony availability and strength from the 2021 drought.

2021 Almond Pollination Survey Results

In February 2021 to April 2021, we conducted an online survey of over 90 commercial beekeepers that participated in the 2021 almond pollination market to better understand their almond pollination decisions. The sample represented over 19% of hives demanded for the 2021 almond bloom. The following sections summarize some key findings of interest. Some participants chose not to answer certain questions, so sample sizes vary and will be indicated in figures, tables and text.

Almond Pollination Fees

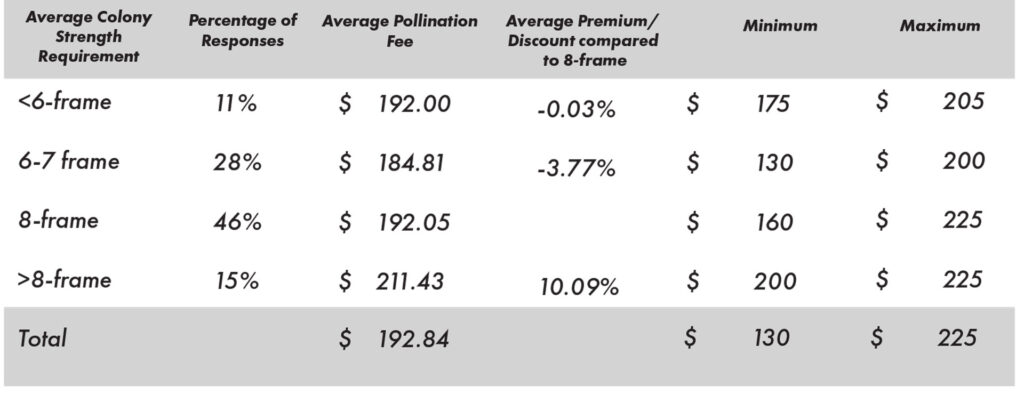

We asked survey respondents to report the fees associated with their largest almond pollination agreement in 2021. Reported fees ranged from $130/colony to $225/colony. Fees vary due to a number of factors, a primary determinant being the colony strength requirement in the agreement. Table 1 shows the average, minimum and maximum pollination fee by colony strength requirement.

Most pollination agreements (46% of those reported) required eight active frames for an average fee of $192 in 2021 (Table 1). Across all frame count categories, the average fee was $193 per colony. Agreements with higher colony strength requirements received a 10% premium compared to eight-frame agreements, while six- to seven-frame agreements saw approximately a 4% discount. Low strength agreements (<6 frames) on average received about the same fees as eight-frame agreements, however this could be due to the small number of these agreements reported.

27% of beekeepers said at least one of their pollination agreements were incentive-based contracts that pay per-frame based on the results of a third-party inspection (see Goodrich and Goodhue 2016 for a sample incentive-based contract.) For the beekeepers whose largest contract was an incentive-based contract, on average, they received $191/colony for a seven-frame average and $210/colony for an 11-frame average. On average, this constitutes a $5 premium per frame over the base fee.

Pesticide Exposure and Agreement Specifics

We asked beekeepers if their colonies had experienced either sublethal or lethal pesticide exposure during the 2020 or 2021 almond pollination seasons. Of the 77 beekeepers who answered this question, 19% and 56% had experienced lethal and sublethal exposure, respectively, in the last two almond pollination seasons. This suggests that pesticide exposure is a relatively common cost that beekeepers have to factor in when making pollination decisions. Growers can follow the Honey Bee Best Management Practices (almonds.com/almond-industry/orchard-management/pollination) to help minimize damage to colonies from pesticide exposure.

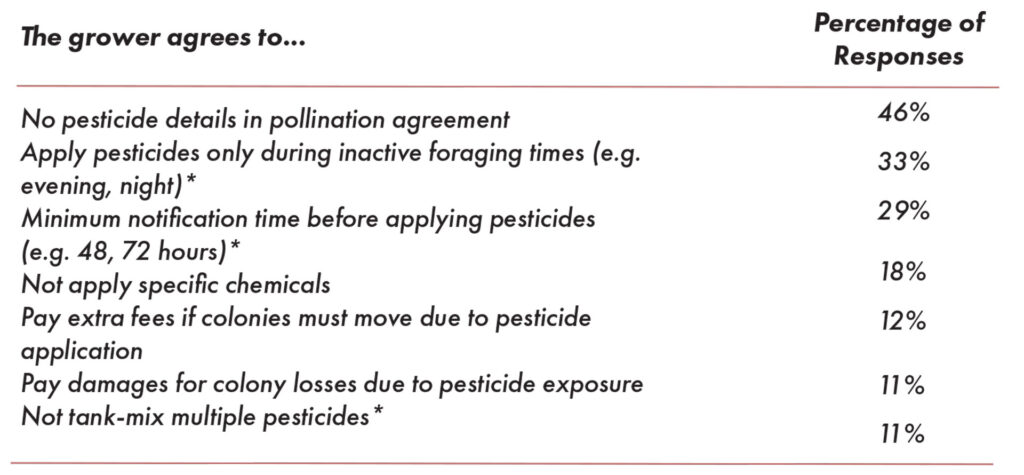

We also asked about language related to pesticide exposure in pollination contracts. Fifty-four percent of beekeepers said that at least one of their pollination agreements contained details to prevent pesticide exposure or to receive compensation if it occurs. Table 2 (see page 47) shows the percentage of beekeepers whose agreements contained language about pesticide exposure by the specific feature. The most common detail included was that the grower would not apply pesticides when bees were active (33%). Eleven percent to 12% of beekeepers stated they had agreements in which they would be reimbursed if colonies had to be moved or were damaged due to pesticide applications.

Advance Payment

Beekeepers were asked if any of their growers/brokers pay some portion of the pollination fee before colonies are placed for almond bloom. Nearly half of respondents (44% of N=91) had at least one contract that pays part of the pollination fee in advance. Twenty-one percent of beekeepers received advanced payments of 30% or less of the total pollination fee. Nineteen percent of participants received over 40% of the total pollination fee in advance. Paying the beekeeper in advance can benefit both parties; it locks the beekeeper into a contract, reducing the grower’s risk that a beekeeper will default, and it provides the beekeeper with working capital to feed and prepare colonies before bloom.

Bee-Friendly Cover Crops

Given the potential benefits cover crops can provide to almond orchards, we investigated beekeepers’ preferences and experiences with bee-friendly cover crops. All cover crop mixes that we inquired about are based on Project Apis m.’s Seeds for Bees cover crop mixes. Of the 89 beekeepers that responded, 21% said that they had at least one grower provide bee-friendly forage in or near the almond orchard they were pollinating. Most of those were from bee-friendly cover crops planted in the almond orchard, but others planted permanent or temporary pollinator habitat as well.

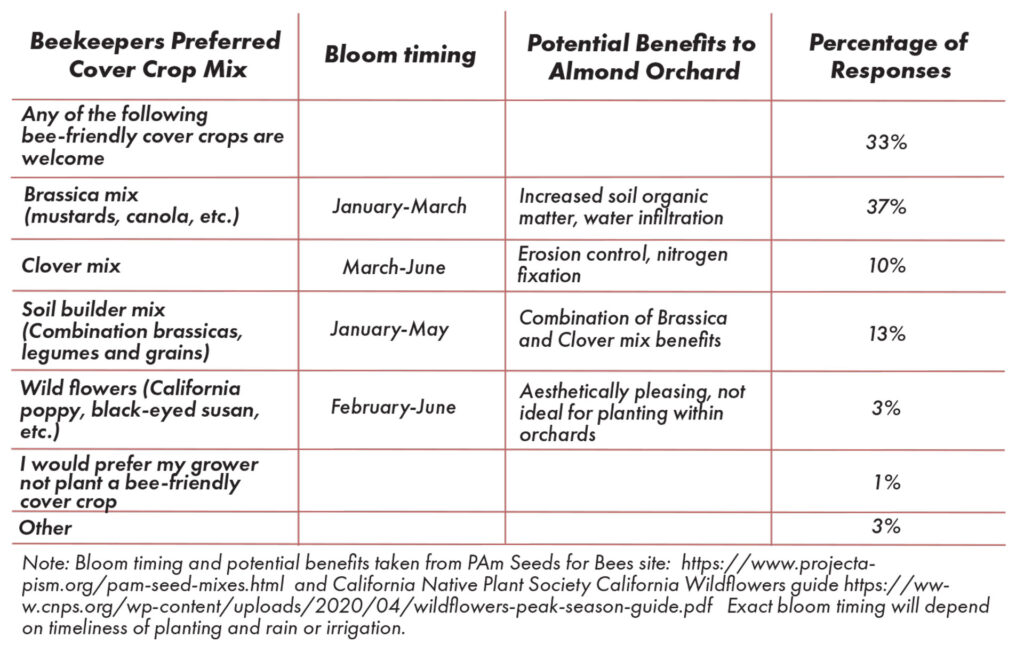

We provided beekeepers with a list of bee-friendly cover crops and asked which cover crop mix they would prefer. Table 3 shows the results for each cover crop mix along with the timing of bloom and potential benefits for the almond orchard. The most popular response was the Brassica mix (37%), which consists of mustards and canola, followed closely by a third of beekeepers responding that any of the bee-friendly cover crops would be welcome. The Soil Builder mix, a combination of brassicas, clovers and grains, was the second most popular mix (13%). The Brassica and Soil Builder mixes are popular due to relatively early bloom timing compared to the other mixes. The Clover mix may not bloom until mid- to late March, at which point it may not be useful for bee colonies if bloom has ended and they have been moved on. This preference for earlier blooming mixes is supported by the responses of two beekeepers who selected “Other” as an option. They said, “Any that would bloom by February 1” and “Anything that would bloom in February to mid-March.”

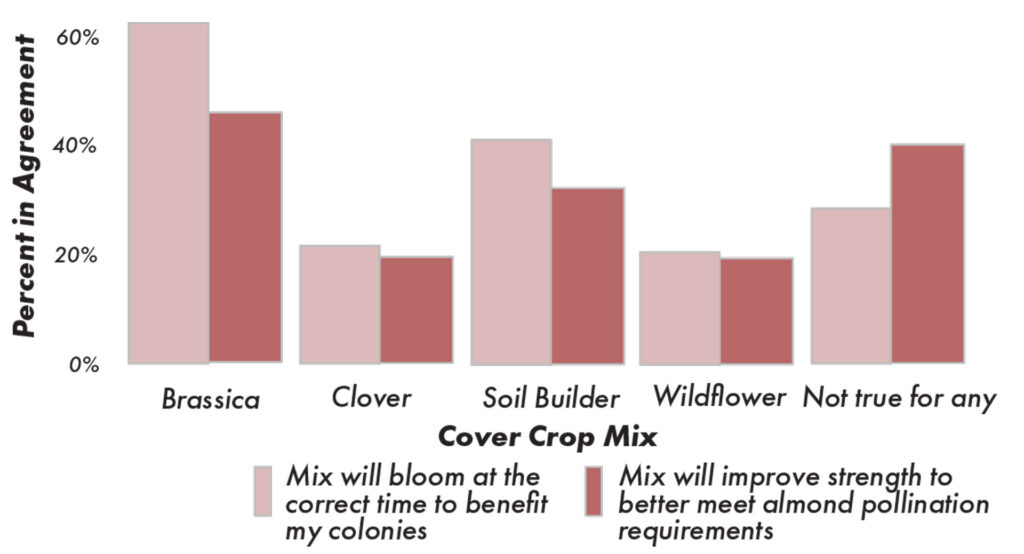

Beekeepers remain hesitant on cover crop benefits because of the uncertainty in the timing of bloom. Even within a cover crop mix, bloom timing can vary substantially due to the timeliness of planting, rain and/or irrigation. Figure 4 (see page 47) displays the percentage of beekeepers that agreed with two statements about individual cover crop mixes. The first statement was, “The cover crop mix will bloom at the correct time to benefit my colonies.” Over 60% of respondents thought the Brassica mix will bloom at the correct time, and over 40% thought the Soil Builder mix would. Respectively, only 22% and 20% thought the Clover and Wildflower mixes would bloom at a beneficial time, and 28% thought none of the mixes would bloom at a time that would be beneficial to colonies. The second statement was, “Mix will improve colony strength to better meet almond pollination requirements.” Due to their early bloom timing, the Brassica and Soil Builder mixes received the highest percentage that agreed, with 46% and 32%, respectively. 40% of respondents did not think that any of the mixes would bloom at a time that would help beekeepers meet colony strength requirements (Figure 4.)

We asked beekeepers about their beliefs regarding various aspects of bee-friendly cover crops planted in almond orchards. As expected, beekeepers’ views of bee-friendly cover crops were positive. Of the 78 beekeepers who responded, 94% and 68% agreed with the statements that cover crops planted for bee forage will improve colony health and decrease feeding costs, respectively. Nearly half of beekeepers agreed that bee-friendly cover crops would reduce colony susceptibility to disease. Few beekeepers believed that bee-friendly cover crops planted in almond orchards would increase pesticide exposure or provide too little forage to be beneficial.

Given that beekeepers clearly care about early blooming mixes, the Soil Builder mix may have the most potential benefits to the grower due to the combination of soil health benefits from multiple cover crop species and the benefit of early nutrition for bee colonies. We also asked beekeepers to indicate the minimum percentage of the almond orchard that needs to be planted in the Soil Builder cover crop mix to be beneficial for their colonies (for reference, we said that the area between tree rows typically makes up 50% of each acre.) 83% of beekeepers who answered (N=52) said that 50% or less of the orchard acreage needed to be in the Soil Builder mix for it to be beneficial and 35% said less than 25% of area needed to be covered. Over half of beekeepers thought that the Soil Builder mix would be beneficial even if the mix does not cover the entire orchard alleyway, this is promising for growers who find it logistically challenging to establish much of the orchard floor in cover crops.

Concluding Thoughts

This summer’s drought across much of the western U.S. may potentially impact the total number and strength of colonies available for the upcoming almond pollination season. We recommend growers check in with their pollination provider early and often to make sure their pollination needs will be met.

In years with high winter losses and low colony strength, pollination fees may rise as bloom nears and colony health and numbers are realized, increasing the economic incentive for an unhappy beekeeper to default on a previously established agreement to capitalize on higher fees. Maintaining a good relationship with your beekeeper can prevent this, whether it’s this year or in the future. Proactively mitigating risks to colonies from pesticide exposure and providing payments in advance are relatively low-cost options for improving upon existing agreements and enhancing the relationship with your pollination provider. Planting bee-friendly forage is a more costly (and initially challenging) practice to implement, but may be worth it when growers factor in both benefits to pollinator and soil health.