Happy New Year! With every new year comes the realization that almond orchards will be in full bloom before long. This article summarizes some considerations for this year’s almond bloom, as well as what to expect in terms of colony supplies and pollination fees in the years to come.

The United States Department of Agriculture (USDA) estimates that there were 1.1 million bearing almond acres in 2018. According to the USDA Cost of Pollination Survey, 1.5 million colonies were used in almond pollination in 2017, with an average 1.6 colonies/acre. This is down from the 2016 average of 1.7 colonies/acre. These values suggest that the number of colonies demanded for almond pollination in 2019 will be close to 2 million. For some context, this is nearly three-fourths of the total U.S. honey bee colony population on January 1, 2018.

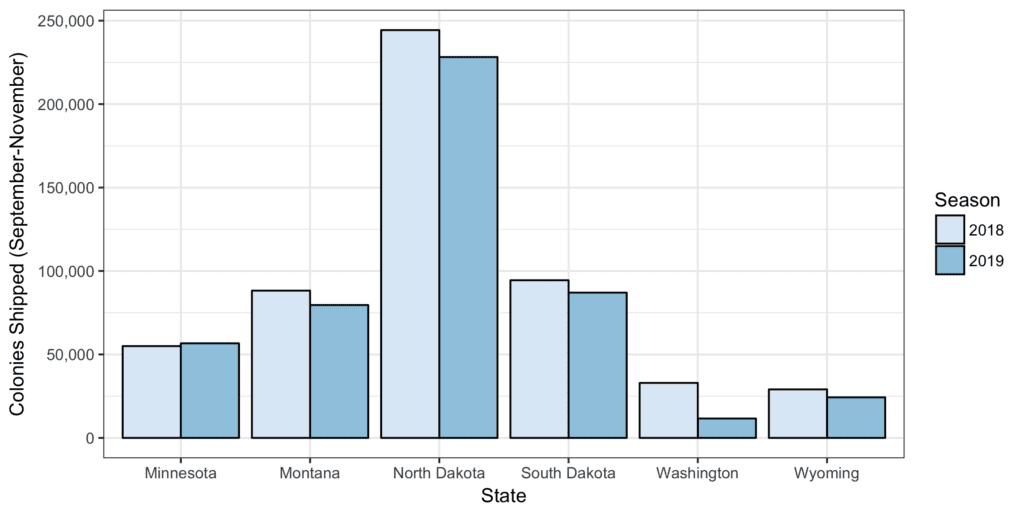

The supply of colonies for California almond pollination relies heavily on out-of-state apiary shipments which have been steadily increasing with almond acreage. According to apiary shipment numbers provided by the California Department of Food and Agriculture (CDFA), 1.8 million colonies were shipped into California for the 2018 almond pollination season. As of November 28, 2018, approximately 661,000 colonies have already been shipped into California for the 2019 almond pollination season. This is a decrease of about 2 percent from colony shipments that had arrived in California by November 28, 2017. Figure 1 displays colonies shipped during September through November from five states that commonly ship into California prior to the new year (mostly states with cold winters). Shipments from these states seem to be down slightly from last year, however not by a large amount.

Figure 1: Honey Bee Colony Shipments into California for Almond Pollination During September through November, Almond Pollination Seasons 2018 and 2019

Source: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services

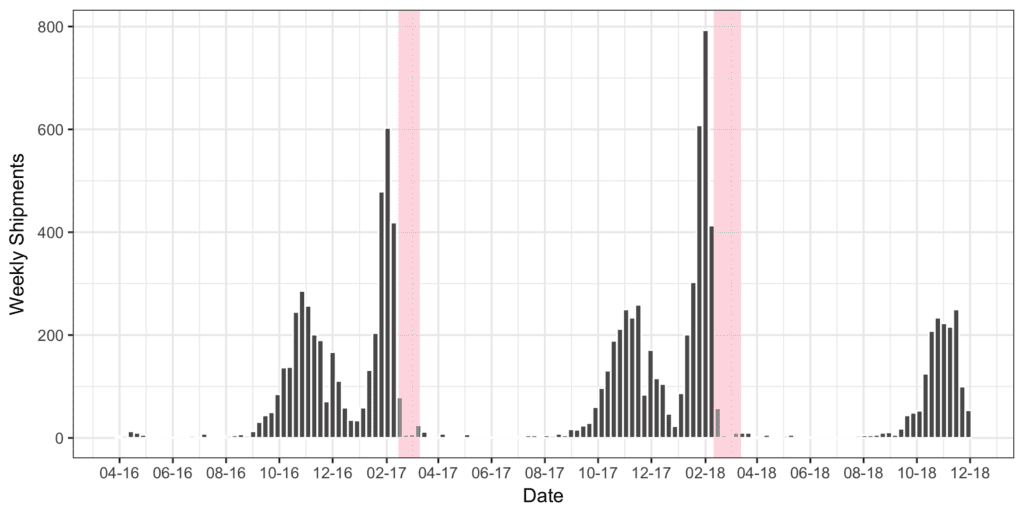

Figure 2 shows a histogram of apiary shipments into California from April 2016 through November 28, 2018. The beginning of shipments for the 2019 almond pollination season look very similar to the previous two seasons. There has been a trend of increasing colony shipments closer to almond bloom. This reflects increased colony shipments from warmer states (Texas, Florida, Georgia) where beekeepers do not have to worry as much about harsh winter weather and can wait longer to ship colonies.

Figure 2: Histogram of Bi-Weekly Apiary Shipments into California, April 2016- November 2018 (Almond Bloom Period for Central California Highlighted)

Sources: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services; Blue Diamond Grower’s Crop Progress Reports

Colony Shipments by State

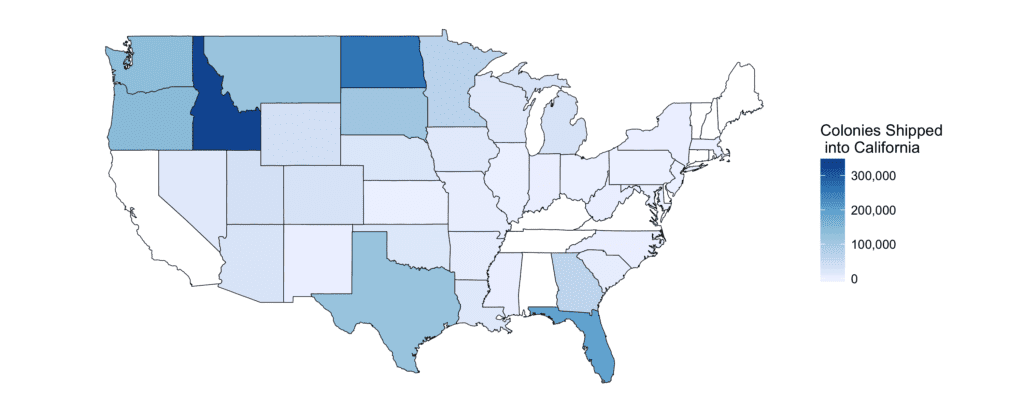

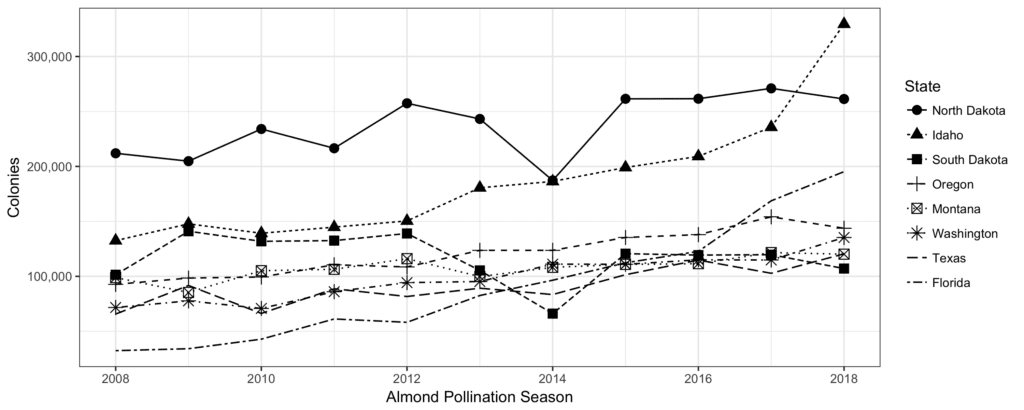

Figure 3 shows a heat map of the number of colonies shipped into California for the 2018 almond bloom from each state. The top five states shipping colonies into California included Idaho, North Dakota, Washington, Florida, and Oregon. Figure 4 shows the trends in colony shipments since 2008 from some of the top supplying states.

Figure 3: Honey Bee Colony Shipments into California for Almond Pollination by State of Origin, Season 2018

Source: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services

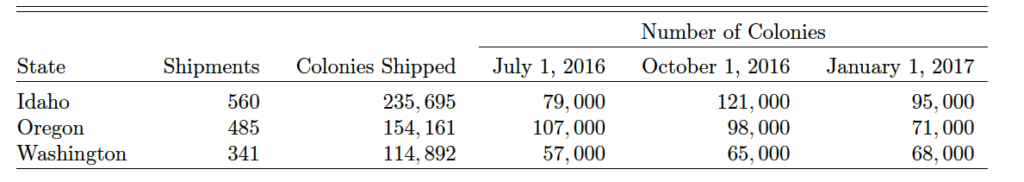

As seen in Figure 4, 2018 was the first year since pre-2008 that any state had shipped more colonies to California than North Dakota. For the 2018 almond bloom, Idaho shipped 339,000 colonies compared to North Dakota’s 278,000. I believe this is due to beekeepers in some of the colder states shipping colonies into the Pacific Northwest states prior to entering California. For example, Table 1 shows Pacific Northwest colony shipments for 2017 almond pollination compared with colony populations reported by USDA. The total number of colonies shipped is often two to three times the colony populations at various points during the year. I suspect some of this is due to the beekeeping industry’s movement towards cold storage of bee colonies. Cold storage of bee colonies can reduce varroa mite populations and decrease colony losses over the winter.

Figure 4: Honey Bee Colony Shipments into California for Almond Pollination from Eight States with Largest Number of Colonies Shipped in 2018, Seasons 2008-2018

Source: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services

Table 1: Pacific Northwest State Colony Populations and Colony Shipments into California for the 2017 Almond Bloom

Sources: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services; USDA Honey Bee Colonies Report 2017

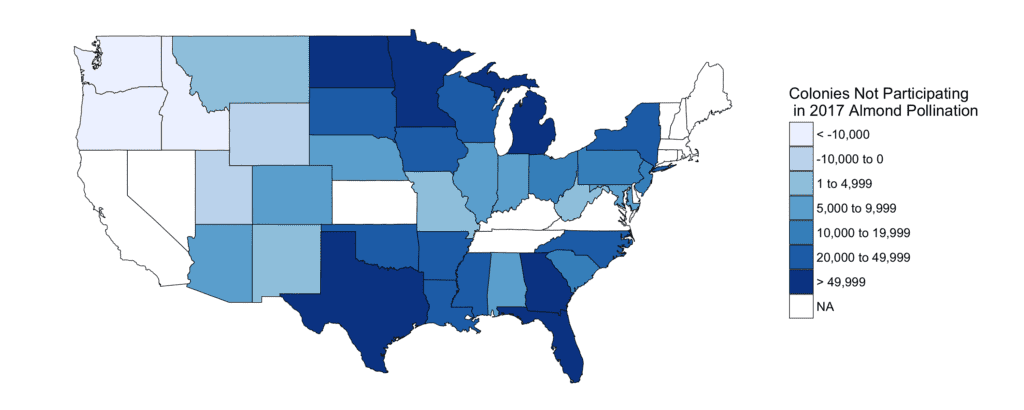

As for the future supply of almond pollination services, Figure 5 displays estimates of the number of colonies that did not participate in 2017 almond pollination in each state based on honey bee colony shipments compared with USDA honey bee colony populations. Most non-participating colonies are located in the eastern U.S. In some areas with a large number of available colonies, ex: Florida, Georgia and Texas, beekeepers may have opportunities for honey production during almond bloom, so it may take higher pollination fees to get remaining colonies to participate. Now, one will notice that there seems to be a large number of colonies still available in the upper Midwest states. As I mentioned earlier, I suspect a large number of these colonies are not available in reality, and are actually being shipped through the Pacific Northwest states due to milder winters and/or cold storage.

Figure 5: State Estimates of the Number of Honey Bee Colonies that did not Participate in 2017 Almond Pollination

NAs exist for Delaware, Nevada, New Hampshire, and Rhode Island because USDA does not publish honey bee populations for these states.

Sources: Apiary Shipments through California Border Protection Stations, CDFA Plant Health and Pest Prevention Services; USDA Honey Bee Colonies Report May 2017

Supply Issues

The primary influence on the supply of available colonies for almond pollination is colony health and populations throughout the U.S. Colony health issues can impact both the strength of colonies (approximate number of bees/hive) and the total number of colonies that survive the winter. In my research, I have found evidence that increases in state average winter mortality rates decrease the number of colonies shipped into California from that state for almond pollination.

An estimated 65-85 percent of commercial honey bee colonies are located in the North Dakota and South Dakota during the spring/summer months for honey production (Bond, Plattner and Hunt, 2014). Thus, weather during this time period can have an impact on honey production, as well as bee health, due to the availability of nutritious forage. In an article I wrote last year, I discussed a drought in the Dakotas and Montana which likely would affect bee health and colony populations for the 2018 almond pollination season. During May through September 2018, an average of 16 percent of the area in Montana, North Dakota and South Dakota was in a moderate drought or worse. The equivalent number for 2017 was 53 percent of the area. Thus, this season is looking much better in terms of bee health coming from these major honey-producing states.

Another potential issue that could impact colony shipments was Hurricane Michael which devastated areas of Florida’s panhandle in October of 2018. University of Florida Extension estimates that 50,000 colonies were located in this area, though it remains unclear how many colonies were actually affected by the hurricane. Florida supplied roughly 195,000 colonies to California almonds in 2018. Thus, the hurricane has the potential to impact up to a quarter of those colonies. This may cause problems for almond growers or pollination brokers who receive bees from Florida.

Almond Pollination Fees

The average fee for the 2018 almond pollination season reported by the California State Beekeeper’s Association (CSBA) was $190 per colony. This was up by 3 percent from the 2017 average pollination fee of $184. In comparison, the USDA Cost of Pollination survey reported 2017 average almond pollination fees slightly lower than CSBA at $171 per colony. The 2018 CSBA pollination fees ranged from $165-$210 per colony. The variation likely is due to differences in contracted colony strength. Colonies that average 8 or 10 active frames tend to receive a premium over those that average 6 active frames (See Goodrich and Goodhue (2016) for more information on colony strength).

The CSBA survey respondents projected 2019 almond pollination fees to be around $198 per colony. In some preliminary research, I explore the future demand for almond pollination services. According to the USDA Almond Acreage Reports, I estimate that 148,000 additional colonies will be needed by 2020. If that is the case, I estimate that almond pollination fees will have to increase by 7.9 percent over their 2017 value to increase colony shipments. This would mean an average per-colony fee of around $200 by 2020. This estimate seems to be right on track with the CSBA projections for the upcoming season.

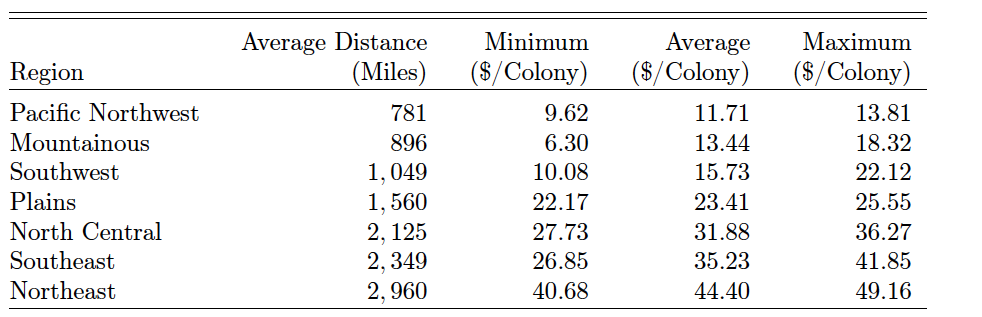

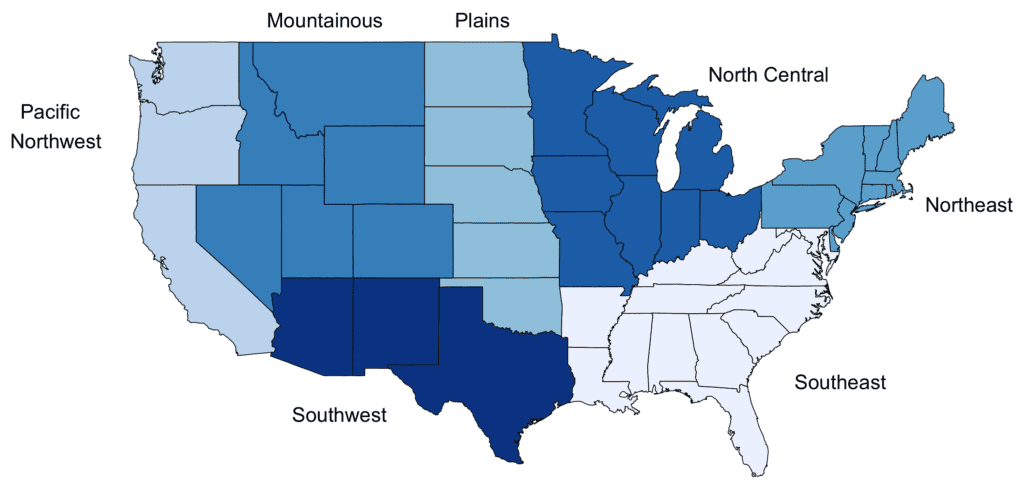

Many almond growers likely cringe at the thought of paying over $200 per colony for almond pollination. However, I wanted to illustrate why prices continue creeping upwards. Table 2 shows average distances and estimated per-colony shipment costs for each region in the U.S. (Figure 6) using a shipment cost of $3 per mile and 400 colonies per shipment. Recall from Figure 3 that colonies are now being transported from as far as the northeastern U.S. to participate in almond pollination. At a $200 pollination fee, the beekeeper from the Northeast is receiving $150-156 per colony once shipment costs are accounted for. This does not include any inputs to prepare colonies for almond pollination (labor, food, pest treatments) nor does it include hotel rooms and transportation costs of beekeepers and equipment. So, one can see that $200 per-colony revenue can dwindle down pretty quickly.

Table 2: Average Distance and Per-Colony Shipment Costs by Region

Figure 6: Beekeeping Regions in the United States

Source: Nye, W. 1980. “Beekeeping Regions in the United States.” Beekeeping in the United States. USDA Agriculture Handbook 335:10–15.

Other issues for 2019 almond pollination and beyond

Bee Thefts

Bee thefts continue to be an issue for beekeepers, especially when colonies are in close proximity in remote almond orchards during bloom. Due to this threat, some beekeepers may provide a discount on the pollination fee to locate in almond orchards or holding yards that contain a locked gate. Keep that in mind if some of your orchards have gates that can be locked.

Bee Where Program

Beginning January 1, 2019, both California and out-of-state beekeepers are required to register their colony locations with the county agricultural commissioner. Previously, this had been required, however the California Agricultural Commissioners and Sealers Association had no authority to penalize non-compliance. The appropriate fine for non-compliance is still under discussion, but it could range from $50 to $1,000. It is my understanding that fines will not be awarded until the 2020 almond pollination season.

The registration cost is $10 per beekeeper, no matter how many colonies. The goal of this program is to help minimize pesticide exposure for honey bee colonies by alerting beekeepers when pesticide applicators plan to apply chemicals nearby. Additionally, this will provide better information on the true causes of bee kills when pesticide exposure does occur.

I suspect most beekeepers will be given information regarding the Bee Where Program when they pass through California Border Protections Stations, however it is a good idea to make sure they are aware of it to avoid fines in the future.

For more information and to register hives online visit: http://beewherecalifornia.com/

Summary

The number of colonies required for almond pollination services continues to be a large percentage of the total colonies in the U.S. If demand for almond pollination services continues to increase, expect higher pollination fees in the coming years. Make sure to communicate with your beekeeper and pollination broker, and maintain good relationships to ensure a secure supply of pollinators going forward. Wishing you a happy, healthy and prosperous 2019!

References:

Bond, J., K. Plattner, and K. Hunt. 2014. “Fruit and Tree Nuts Outlook: Economic Insight. US Pollination Services Market.” USDA Economic Research Service Situation and Outlook FTS-357SA.

Goodrich, B. and R.E. Goodhue. 2016. “Honey Bee Colony Strength in the California Almond Pollination Market.” ARE Update 19(4): 5-8. University of California Giannini Foundation of Agricultural Economics.

[…] ago, farmers could expect to pay about $30 to rent the services of one honey bee hive, these days it’s around $200. For some almond farmers, pollination fees can account for about a quarter of their total overhead […]

Comments are closed.