For those doing business in California, this is a question that gets asked every time another regulation gets passed or when the minimum wage goes up as it did again on Jan. 1. When it comes to the tree nut industry, the naysayers tell us there is no one to compete with so what’s the issue? Well, for one reason, that’s not true. The tree nut industry competes with other countries and, in the case of pistachios and pecans, states. Furthermore, consumers will only pay so much. For example, when the price of almonds gets too high, at least one cereal maker cuts back on how many almonds they used. Unfortunately, it’s truly getting to a point where businesses can’t compete. It’s why a walnut processor moved to Sparks, Nev., why an almond processor moved to Texas, and one reason why almonds are being tried in Arizona. There is no longer any doubt about it; the regulatory climate and corresponding economic impact is clearly taking its toll.

Understandably, the cost of ginning cotton is an important concern for cotton producers and cotton ginners. While it isn’t specifically for almond hullers or walnut processors, a paper was recently published by USDA-ARS that demonstrated just how bad the disparity in cotton gin operating costs is between California and other states in the country.

Cost of Doing Business

Every three years, USDA-ARS conducts a survey of cotton gins across the country to determine cotton ginning costs by region. Data from this survey allows cotton gin management to compare their operation to regional and national data, and provides information about key variable costs as a component of the overall cost of ginning cotton. The survey looks at the costs of repairs, bagging and ties, labor, drying fuel and electricity. These five costs make up the operating cost of a typical cotton gin. The data helps to identify trends of gin operation and document how the adoption of new technologies in cotton harvesting and ginning has impacted ginning cost.

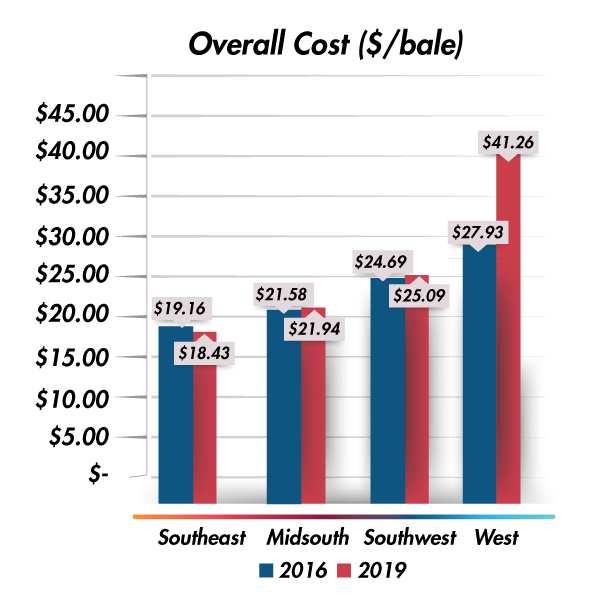

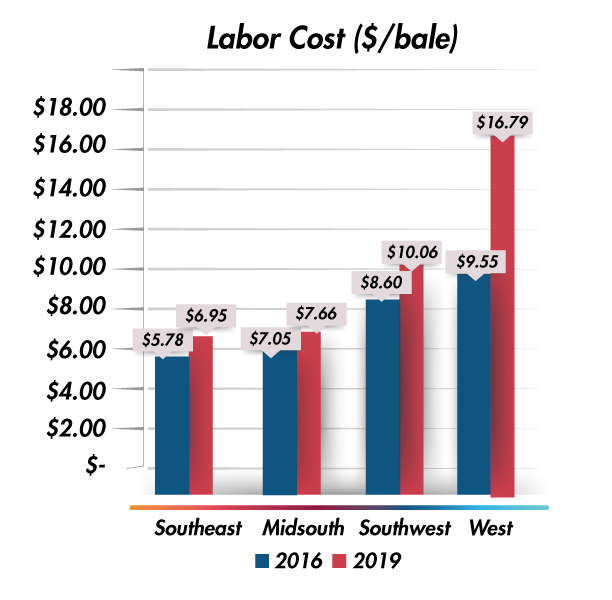

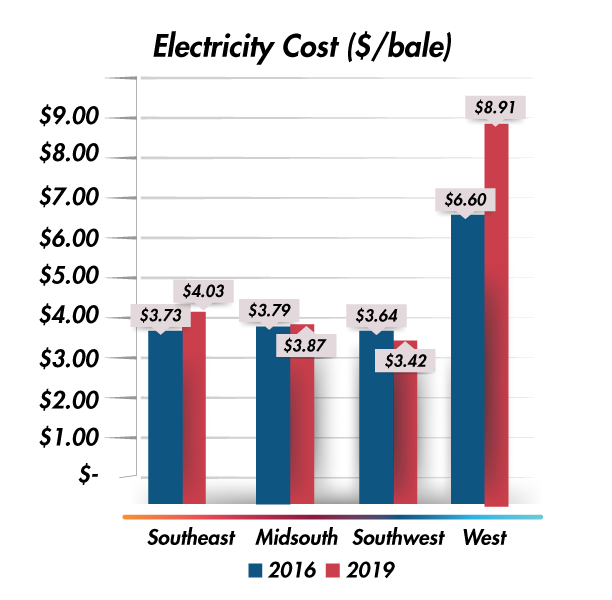

In their most recent survey conducted in 2019, USDA-ARS released the preliminary results. While a cost discrepancy is expected for the West compared to the rest of the cotton belt, the significance of the amount of discrepancy was not. The results clearly demonstrate the unlevel playing field between California and the rest of the cotton belt. The largest impacts are felt in labor costs as a result of California’s high minimum wage; and electricity rates, where California’s energy and environmental policies heavily impact rates. Overall, cotton gins in California operating in 2021 have costs more than $16/bale higher than any other cotton growing state. That is up from a little more than $12/bale only three years prior from the last comparison in 2016, when the discrepancy was only $4.55 per bale.

In the charts provided, California makes up 90% of the “West” cost numbers. In looking at labor costs, California was more than $6.73 higher than the next highest region and more than $7 higher than the national average. Upon reviewing electricity costs, California was $4.88 higher than the next highest region and $4.73 higher than the national average.

Widening Discrepancy

What’s really disturbing is the fact that it is getting worse. In comparing the results to the 2016 USDA-ARS report, it is clear the disparity is increasing. Overall, the difference in total operating cost between California and the rest of the nation grew from $4.55 per bale in 2016 to $16.85 per bale in 2019. This is primarily driven by the increase in electricity and labor costs.

While other states are looking at an increase in minimum wage, many states rely upon the national minimum wage as the standard. Until it is increased, the disparity will remain. Furthermore, the climate change regulation and wildfire safety concerns will continue to force electricity rates higher in California, so relief from the disparity in the near future will not be seen. Many hullers and processors continue to automate to the extent possible to reduce labor costs, and many operations have installed solar to offset rising electricity costs.

So, when people wonder why someone might try planting almonds in Arizona, maybe now it makes sense. Their operating costs are much lower and they don’t have the regulatory pressures California does. They don’t even have a Heat Illness Regulation like California, despite being much hotter for a longer portion of the year!

References

1. “The Cost of Ginning Cotton”, Holt et al., 2021 Beltwide Cotton Conference Proceedings, USDA ARS.

2. Valco, T.D., H Ashley, D.S. Findley, J.K. Green, R.A. Isom, and T. L. Price, 2018, The Cost Of Ginning Cotton – 2016 Survey Results, 2018 Proceedings of Beltwide Cotton Conferences, National Cotton Council, Memphis, TN. CDROM.