In February, Governor Newsom signed into law SB 114, which reinstated 80 hours of COVID-19 Supplemental Paid Sick Leave (SPSL) for companies with 26 or more employees through September 30, 2022. This iteration of COVID-19 SPSL is not an exact replica of the 2021 SPSL, and employers need to ensure they have a procedure to implement it correctly. In this article, we will highlight the critical elements of the 2022 COVID-19 SPSL and identify potential pitfalls for agricultural employers.

Calculating Employees

One of the most frequently asked questions in the ag industry is how to determine if you meet the 26-or-more employee threshold. With the seasonality of crops and our workforce, employee numbers can fluctuate throughout the year. The California Division of Industrial Relations (DIR) directs employers to follow their company size based upon the minimum wage rates. Additionally, if you are a grower that contracts with a farm labor contractor, then you will need to include those workers into your employee count.

Employee Notification

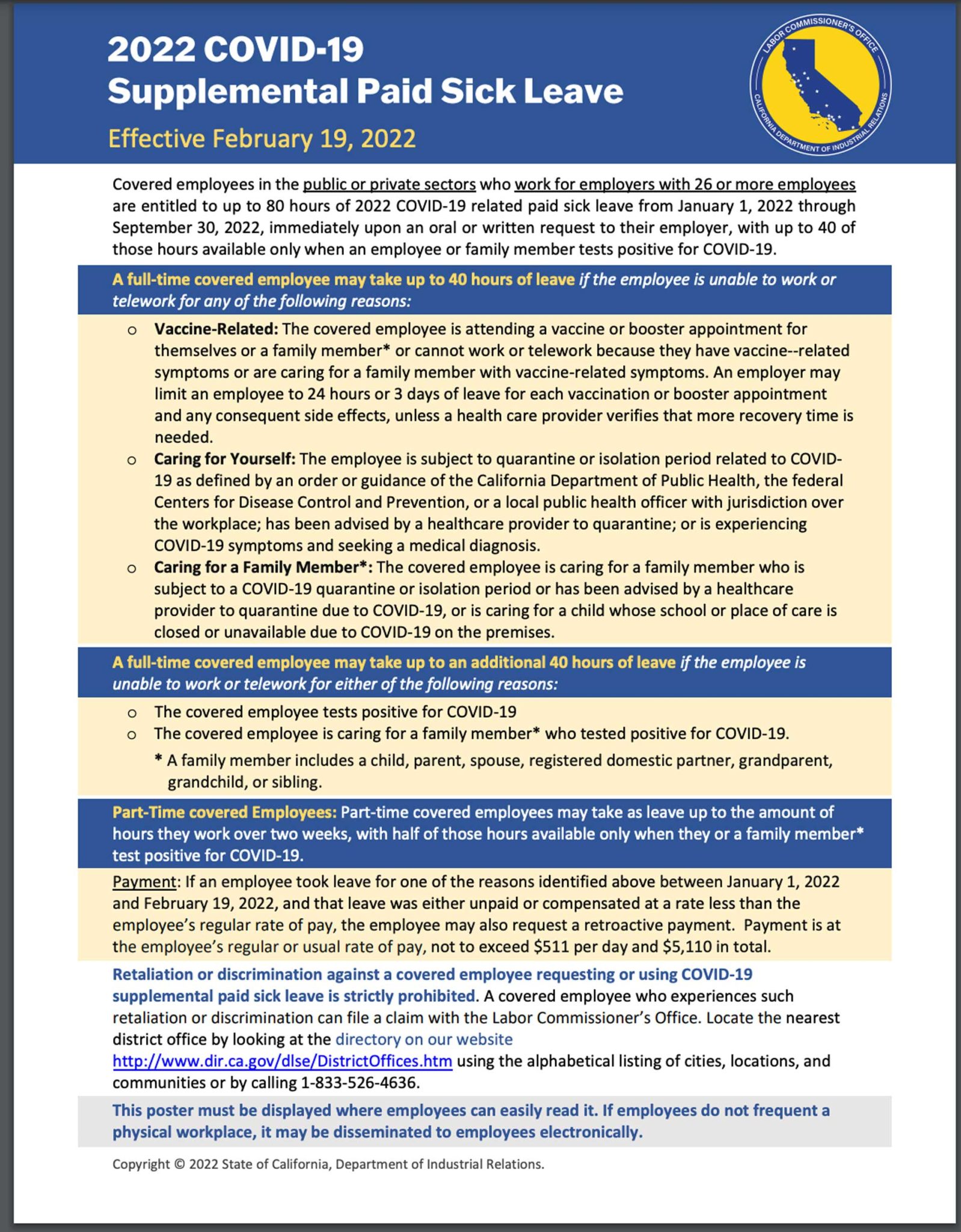

It is critical that employers who are required to provide COVID-19 SPSL notify employees of their rights under the law. DIR has developed an informational flyer in both English and Spanish in which employers are required to post and review with their employees. The link to this poster can be found here: dir.ca.gov/dlse/COVID19resources/COVIDPostings.html.

Retroactive Pay

While the law went into effect February 19 of this year, employers are required to provide SPSL to employees beginning January 1, 2022. This means if an employee was out sick or took time off because of a qualified COVID-19 related issue between January 1 through February 18, they would have access to their bank of 80 hours. As an employer, you are required to notify employees of the benefits; however, it is up to the employee to request the time either verbally or in writing. Once an employee requests COVID-19 SPSL, an employer will have until the payday for the next full pay period to pay the “retroactive” 2022 COVID-19 Supplemental Paid Sick Leave.

Leave Banks

Unlike the prior 2021 SPSL, this new law breaks the amount of time employees can take into two 40-hour banks for a total of 80 hours. According to DIR, an employee is eligible to access the first bank of time if they are unable to work or telecommute for the following reasons:

Caring for Yourself: The covered employee is subject to a quarantine or isolation period related to COVID-19 (see note below) or has been advised by a healthcare provider to quarantine due to COVID-19, or is experiencing symptoms of COVID-19 and seeking a medical diagnosis.

Caring for a Family Member: The covered employee is caring for a family member who is either subject to a quarantine or isolation period related to COVID-19 (see note below) or has been advised by a healthcare provider to quarantine due to COVID-19, or the employee is caring for a child whose school or place of care is closed or unavailable due to COVID-19 on the premises. See FAQ 6 for the definition of family member and child.

Vaccine-Related: The covered employee or a qualifying family member is attending a vaccine appointment or cannot work or telework due to vaccine-related side effects.

The second bank of 40 hours is available only if an employee or a family member for whom they are providing care tested positive for COVID-19. For this second bank, an employer is allowed to request proof from their employee, and under this regulation, an at home rapid COVID-19 test would qualify. If you decide to require proof, ensure it is a part of your procedure and you follow the same process with all your employees.

It is at the employee’s discretion to indicate which bank of time they would like to utilize. Please note: all SPSL time taken shall be itemized on the employee’s pay stub with the bank or banks of time they have drawn upon.

There are numerous other nuances included within this regulation, and we strongly encourage all employers and their teams to review the COVID-19 SPSL FAQs on the DIR website. The FAQs are thorough and provide examples to assist with implementation. The link for the FAQs in both English and Spanish can be found here: dir.ca.gov/dlse/COVID19Resources/2022-SPSL-FAQs.html. If you should have additional questions regarding COVID-19 SPSL, please contact the AgSafe office at 209-526-4400 or send an email to safeinfo@agsafe.org.

For more information about worker safety, human resources, labor relations, pesticide safety or workforce development, please visit www.agsafe.org, call (209) 526-4400 or email safeinfo@agsafe.org. AgSafe is a 501c3 nonprofit providing training, education, outreach and tools in the areas of safety, labor relations and human resources for the food and farming industries. Since 1991, AgSafe has educated over 100,000 employers, supervisors and workers about these critical issues.