Off and on. That rhythm is the cadence for pistachio yields. On and on is what exports need to be. Last year two-thirds of U.S. pistachios crossed borders or sailed oceans. California producers have planted pistachio trees at a faster rate than any other tree nut variety over the last decade. Watching production grow, the RaboResearch team developed a supply-and-demand analytical tool to help growers anticipate prices levels for the next five years.

Supply Growth is Set to Continue

Pistachio bearing acreage grew more than twofold over the last decade, making pistachios California’s fastest-growing tree nut in terms of acreage. From 2024, bearing area will sit at about 370,000 acres—roughly a 40 percent increase (see Figure 1). Industry estimates show that average pistachio net returns per acre exceed those obtained in competing nuts, creating incentives for new plantings.

A relevant proportion of pistachio’s planted acreage is located in the Southern San Joaquin Valley, a water-challenged area. The Sustainable Groundwater Management Act (SGMA) will limit future growth. For this reason, estimates indicate that non-bearing acres will remain stagnant for a few years and then decline by the end of the projection period. Yet bearing acres will be at record-breaking levels every year for the next several years.

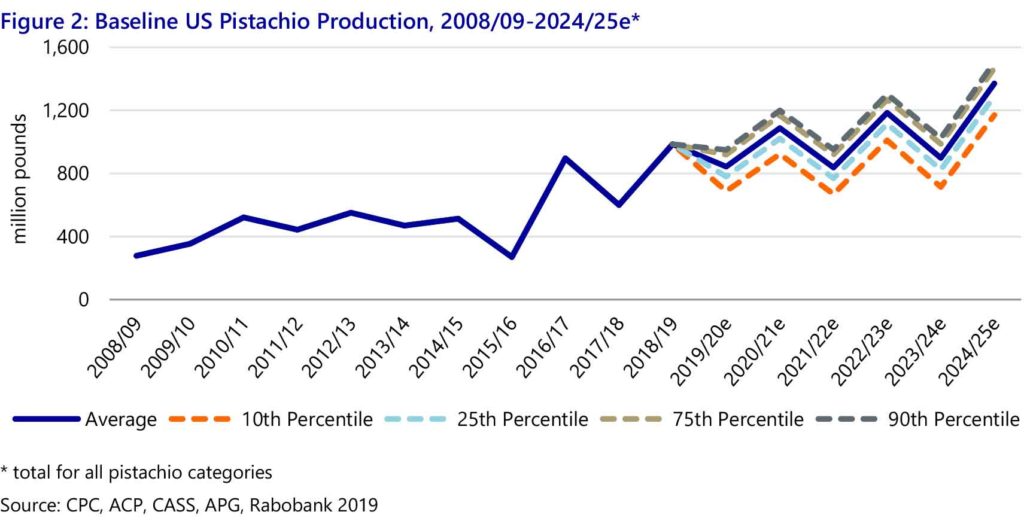

After reaching a record crop in 2018, pistachio production in California is set to continue to grow. Rabo AgriFinance’s market outlook, based on its pistachio supply-and-demand analytical tool, predicts that the 2019 crop will be the third-largest on record, while the 2020 crop should break the one-billion pound barrier. Moreover, pistachio production should reach new record levels in 2022 and 2024, as those are expected to be “on” years. Average yields will likely increase over the projected period as more trees reach maturity and full production. The analysis takes yield variability into consideration and assumes there will be no interruptions to the alternate bearing nature of yields.

Whereas a colder spring may delay pistachio maturity this year, some expect this to be an exceptional “off” year. For 2019, the estimated average yield of about 2,900 lb/acre would result in an expected production of just below 850 million pounds. For 2024, the estimated average yield of about 3,700 lb/acre would provide expected production of about 1.37 billion (bn) pounds. Accounting for potential variability, Rabo AgriFinance estimates that there is a 50 percent probability that production will be between 1.29bn and 1.46bn pounds in 2024 (see Figure 2).

Demand Growth Is Necessary

Demand continues to grow, as pistachios fit into the category of a healthful, convenient and tasty snack. China is the main export market for U.S. pistachios, followed by the European Union (EU) market. Despite trade concerns, pistachio shipments during the 2018/19 marketing year continue at a strong pace. For several months, the U.S. industry took advantage of a raw vs. roasted pistachio tariff differential going into China (45 percent vs. 15 percent) by focusing on shipping roasted products. However, in the June 2019 retaliatory tariffs, China increased tariffs on U.S. processed pistachios, eliminating that option to avoid higher tariffs.

The potential negative effect of China’s tariffs has been partially offset by less competition from Iranian product. Iran produced about 35 percent of global pistachio production in 2017/18, but extreme weather conditions severely impacted the 2018/19 Iranian crop—a 66 percent reduction year over year. Given the two-year cycle of pistachio (bud) development, some industry analysts expect the Iranian crop to still be down during the 2019/20 marketing year.

The U.S. is the leading pistachio-exporting country, usually accounting for about 60 percent of global exports. However, given the decline in Iranian exports, U.S. exports will make up about three-quarters of the world’s pistachio exports in 2018/19.

U.S. exports to China, fostered by a fast-growing middle-class population, have grown fourfold over the last decade—from about 50 million pounds in 2008/09 to more than 200 million pounds in 2017/18. If tariffs on U.S. pistachios are removed after the 2019/20 marketing year, Rabo AgriFinance expects that exports to China will continue to grow, retaining the country’s place as the main destination for U.S. pistachios.

Effective marketing campaigns and product differentiation seem to be fostering worldwide demand, too. Product innovation includes different package sizes, shelled pistachios, as well as non-salted or flavored pistachios. Marketing strategies—such as early shipping to make sure U.S. pistachios reach Chinese consumers before the Chinese New Year celebrations—have paid off, according to industry sources.

The industry has also been working on developing domestic demand. Per capita pistachio use in the U.S. has grown at a Compound Annual Growth Rate (CAGR) of about 8 percent during the last decade, to about 0.45 pounds per capita per year. While pistachio consumption lags behind almond’s 2.3 pounds-per-capita use, there is plenty of room to grow.

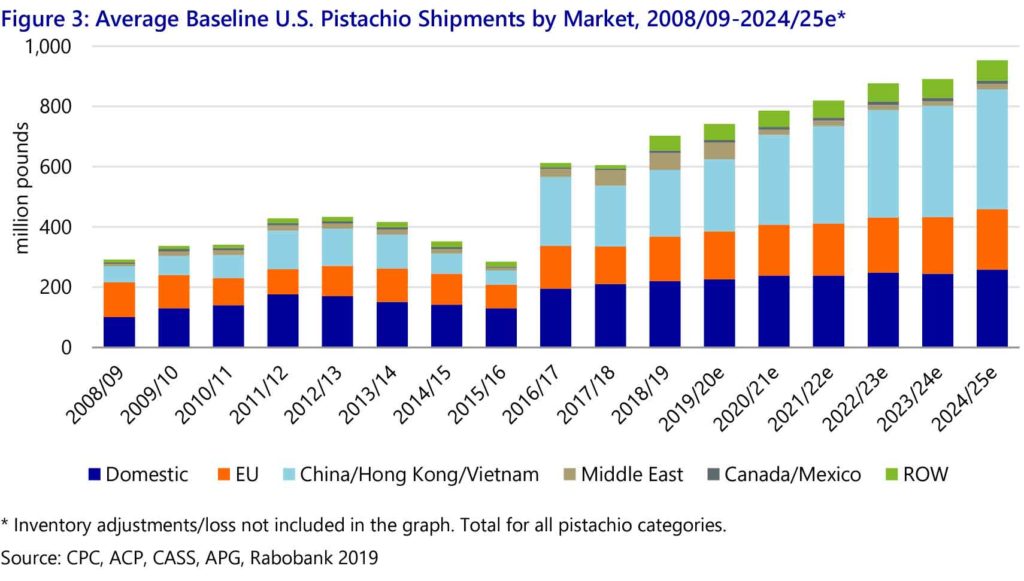

The composition of U.S. shipments has shifted considerably, as export shipments have grown faster than domestic shipments. During the 2000/01 marketing year, only about one-third of total shipments were exported. Currently, about two-thirds of U.S. pistachios are sold internationally. We expect this trend to continue over the next few years.

Rabobank expects total pistachio shipments to surpass 950 million pounds by 2024/25. Figure 3 shows the average shipments broken down by main markets. Assuming tariffs by China are eliminated in 2020/21, there is an increase in shipments to the Asian market. On the other hand, shipments to the Middle East will decline starting in 2020/21, as the Iranian crop returns to normal levels (see Figure 3).

As for ending stocks, the average estimate for 2018/19 is 180 million pounds. For the next few years, ending stocks will grow but should maintain manageable inventory levels under baseline conditions.

Average Expected Prices aren’t too Shabby

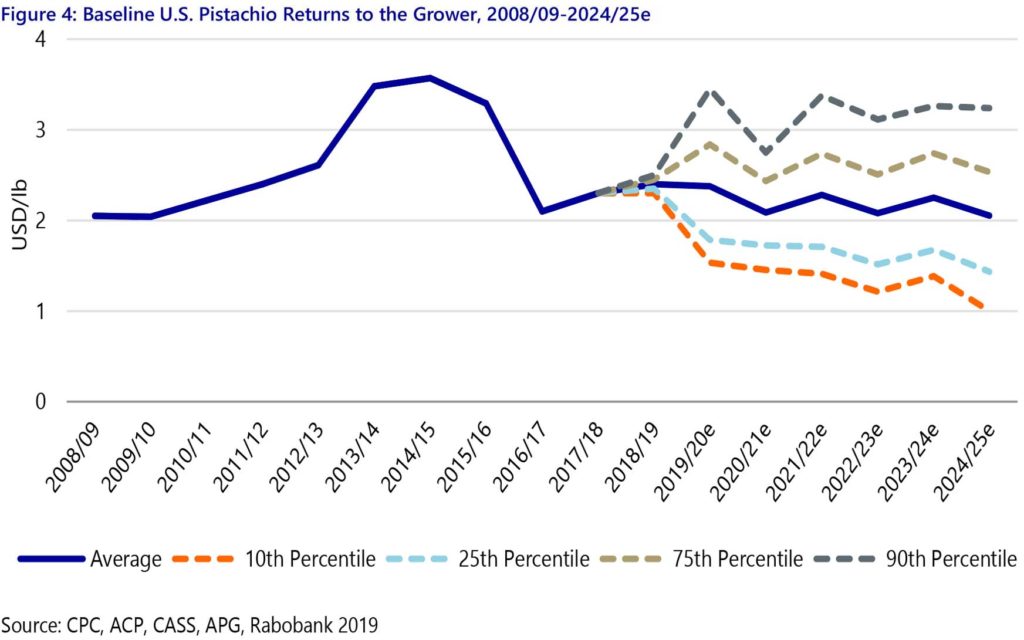

Based on the average supply-and-demand expectations, average returns to the grower would range from $2.05/lb to $2.38/lb between the 2019/20 and 2024/25 marketing seasons. The price outlook for 2019/20 remains positive, as reduced Iranian shipments would propel demand for U.S. product in export markets. As we look further out, prices show a slight downward trend, with some variation reflecting the alternating on and off years. For example, 2020/21 should be an “on” year, and there’s a 50 percent chance of having farm prices between $1.73/lb and $2.43/lb (see Figure 4). Depending on individual grower yields, there is a high likelihood that average blended prices will remain at profitable levels for most growers in California over the projection period.

But Things can Always get Worse… or Better

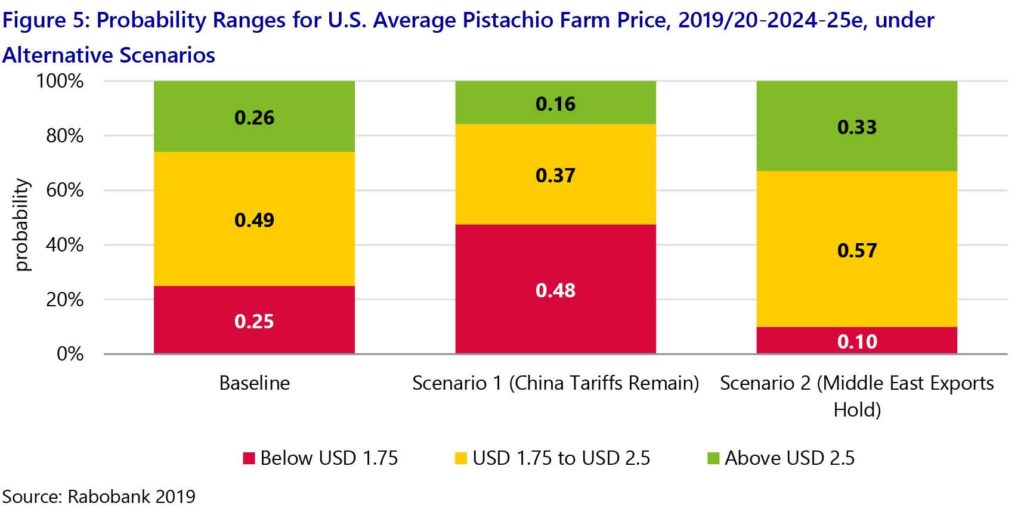

In the baseline analysis, Rabo AgriFinance assumes: 1. retaliatory tariffs for U.S. pistachios are lifted after the 2019/20 marketing year, and 2. the Iranian crop returns to normal levels in 2020/21, increasing export market competition, particularly in Middle Eastern countries.

Under the baseline scenario, Rabo AgriFinance estimates about a 26 percent chance of having a six-year average price above $2.50/lb. The probability that the average price is between $1.75/lb and $2.50/lb is about 49 percent, while the probability of having an average price below $1.75/lb is about 25 percent.

Now, let’s look at two different scenarios. In scenario 1, Chinese tariffs remain in place and gray trade to China is enforced, adding tariffs to U.S. shipments going to Hong Kong and Vietnam. In scenario 2, Middle East demand for U.S. product holds, despite a return of the Iranian crop, while Chinese retaliatory tariffs are removed. In all scenarios, U.S. production assumptions remain the same.

Under scenario 1, access to the main market for U.S. pistachios is constrained by tariffs, and the chances of having a six-year average farm price above $2.50/lb declines to about 16 percent, with increasing downside risk. The probability of having an average price below $1.75/lb increases to about 48 percent.

Under scenario 2 (the most optimistic one), exports to China and the Middle East continue to grow at the current pace, supporting prices. The probability of an average price north of $2.50/lb increases to 33 percent, while the chances of having an average price south of $1.75/lb declines to about 10 percent (see Figure 5).

These scenarios show the critical relevance of maintaining access to international markets.

Downside risks on U.S. exports—and subsequently on U.S. price—include potential increased competition from other producing regions. For example, there are indications of rapid increases in Turkish pistachio production. The lower percentiles of the scenarios’ price estimates capture that possibility and other relevant risks, including extreme scenarios such as the recently announced intention of China to stop buying U.S. agricultural products.

Looking Ahead

The U.S. pistachio industry has performed well the last few years. With access to export markets unknown, producers need to do whatever they can to protect and grow demand.

Continue offering good-quality product and following strict food safety practices. On the marketing side, continued efforts are needed to capitalize on encouraging consumer trends, and to effectively market increasing volumes in order to maintain prices at profitable levels. Partnerships with key marketers and retailers have proven successful. Considering that pistachio per-capita use is still low compared to other tree nuts, there is plenty of room for this category to grow—both in the domestic and export markets.